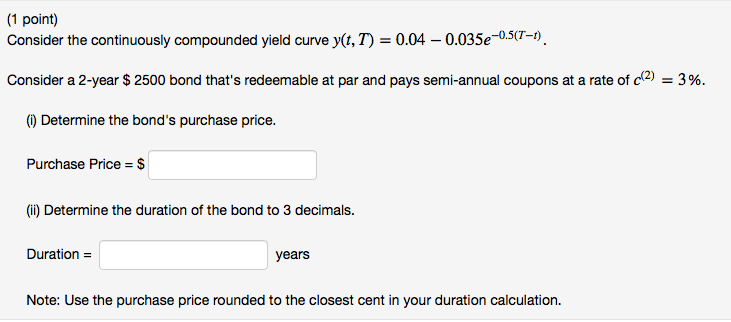

Question: Consider the continuously compounded yield curvey(t,T)=0.04-0.035e^(-0.5)(T-t) Consider a 2-year $ 2500 bond that's redeemable at par and pays semi-annual coupons at a rate ofc(2)=3%. (i)

Consider the continuously compounded yield curvey(t,T)=0.04-0.035e^(-0.5)(T-t)

Consider a 2-year $ 2500 bond that's redeemable at par and pays semi-annual coupons at a rate ofc(2)=3%.

(i) Determine the bond's purchase price.

(ii) Determine the duration of the bond to 3 decimals.

{1 point] Consider the continuously compounded yield curve y, T) = [1114 - H.0353'5{T. Consider a 2-year $ 250D bond that's redeemable at par and pays semi-annual coupons at a rate of .511] = 3 95. [i] Determine the hond's purchase price. Purchase Price = iii [ii]: Determine the duration of the bond to 3 decimals. Duration = years Note: Use the purchase price rounded to the closest cent in your duration calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts