Question: Consider the convertible bond arbitrage example on Slides 37-42. It can be shown that the convertible bond should be trading at $103.81 (this is shown

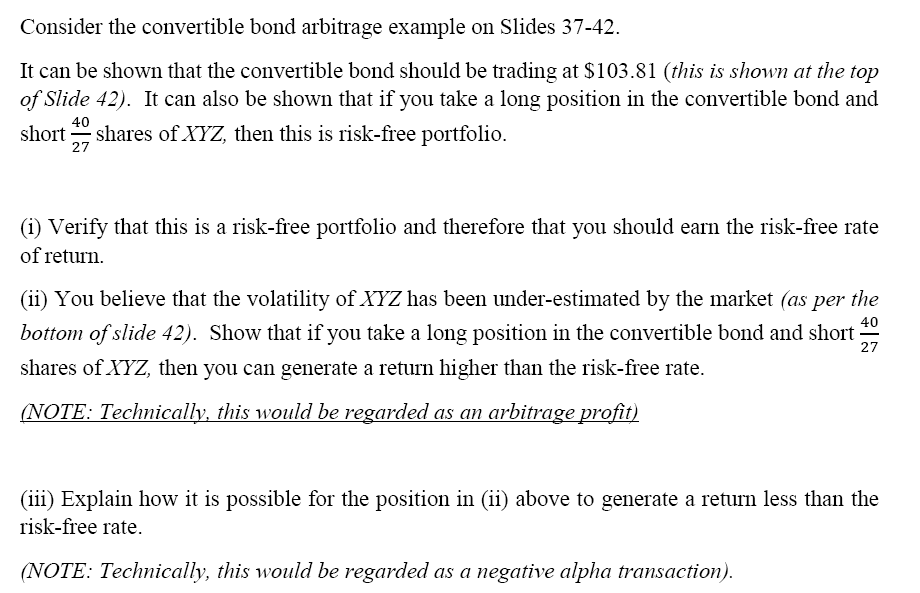

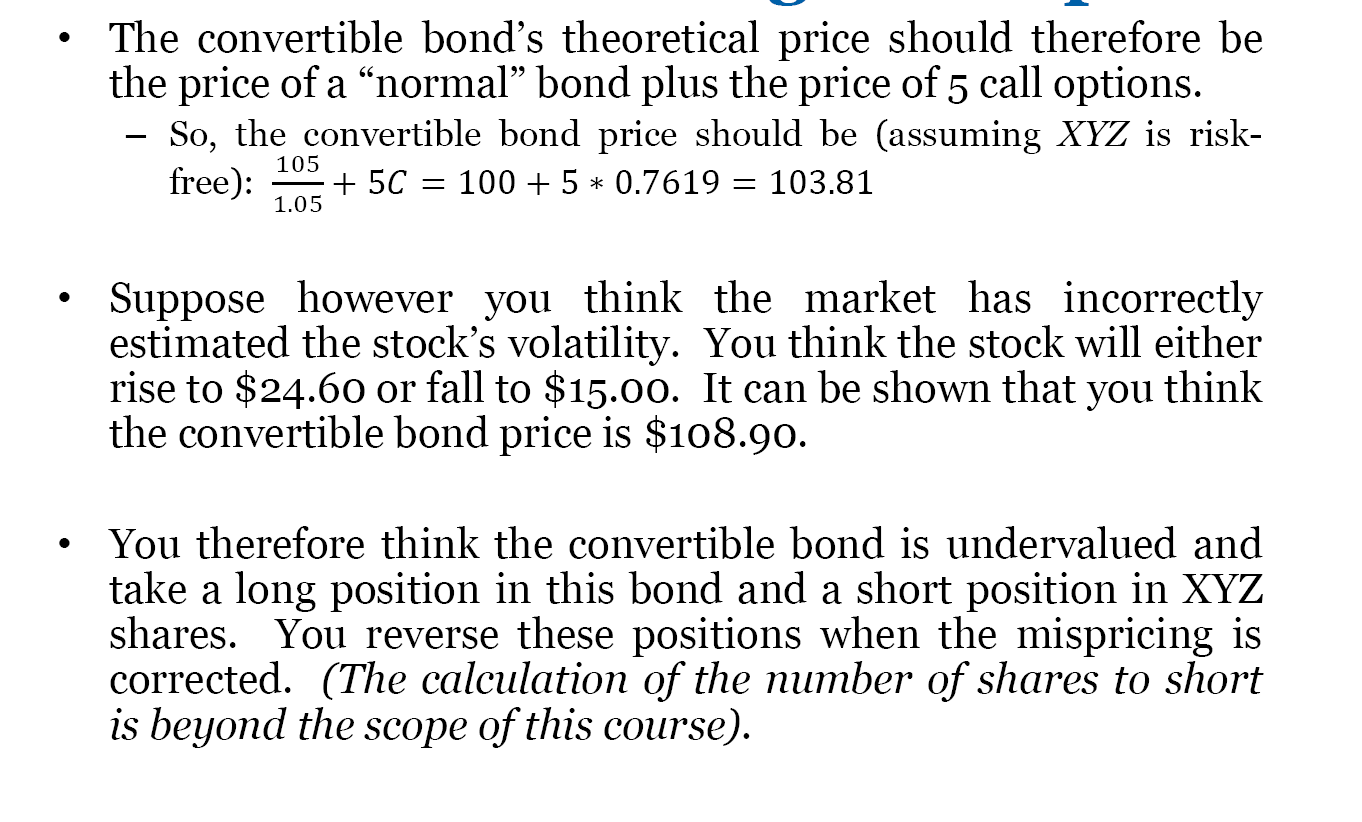

Consider the convertible bond arbitrage example on Slides 37-42. It can be shown that the convertible bond should be trading at $103.81 (this is shown at the top of Slide 42). It can also be shown that if you take a long position in the convertible bond and 40 short shares of XYZ, then this is risk-free portfolio. 27 (i) Verify that this is a risk-free portfolio and therefore that you should earn the risk-free rate of return. 40 (ii) You believe that the volatility of XYZ has been under-estimated by the market (as per the bottom of slide 42). Show that if you take a long position in the convertible bond and short shares of XYZ, then you can generate a return higher than the risk-free rate. 27 (NOTE: Technically, this would be regarded as an arbitrage profit) (iii) Explain how it is possible for the position in (ii) above to generate a return less than the risk-free rate. (NOTE: Technically, this would be regarded as a negative alpha transaction). The convertible bond's theoretical price should therefore be the price of a "normal" bond plus the price of 5 call options. So, the convertible bond price should be (assuming XYZ is risk- free): + 5C = 100 + 5 * 0.7619 = 103.81 105 1.05 Suppose however you think the market has incorrectly estimated the stock's volatility. You think the stock will either rise to $24.60 or fall to $15.00. It can be shown that you think the convertible bond price is $108.90. You therefore think the convertible bond is undervalued and take a long position in this bond and a short position in XYZ shares. You reverse these positions when the mispricing is corrected. (The calculation of the number of shares to short is beyond the scope of this course). Consider the convertible bond arbitrage example on Slides 37-42. It can be shown that the convertible bond should be trading at $103.81 (this is shown at the top of Slide 42). It can also be shown that if you take a long position in the convertible bond and 40 short shares of XYZ, then this is risk-free portfolio. 27 (i) Verify that this is a risk-free portfolio and therefore that you should earn the risk-free rate of return. 40 (ii) You believe that the volatility of XYZ has been under-estimated by the market (as per the bottom of slide 42). Show that if you take a long position in the convertible bond and short shares of XYZ, then you can generate a return higher than the risk-free rate. 27 (NOTE: Technically, this would be regarded as an arbitrage profit) (iii) Explain how it is possible for the position in (ii) above to generate a return less than the risk-free rate. (NOTE: Technically, this would be regarded as a negative alpha transaction). The convertible bond's theoretical price should therefore be the price of a "normal" bond plus the price of 5 call options. So, the convertible bond price should be (assuming XYZ is risk- free): + 5C = 100 + 5 * 0.7619 = 103.81 105 1.05 Suppose however you think the market has incorrectly estimated the stock's volatility. You think the stock will either rise to $24.60 or fall to $15.00. It can be shown that you think the convertible bond price is $108.90. You therefore think the convertible bond is undervalued and take a long position in this bond and a short position in XYZ shares. You reverse these positions when the mispricing is corrected. (The calculation of the number of shares to short is beyond the scope of this course)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts