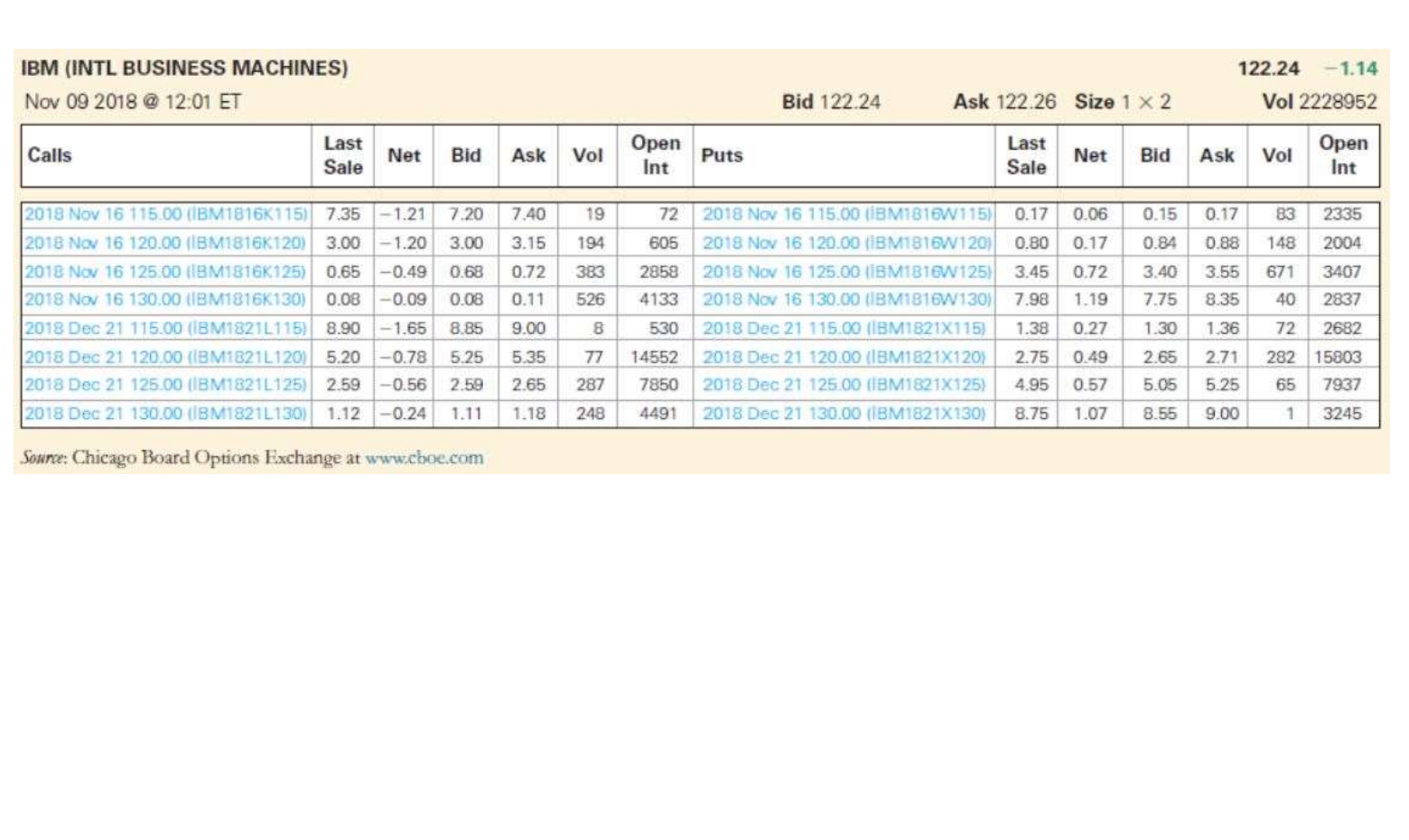

Question: Consider the data for IBM options in the table, LOADING... . Suppose a new American-style put option on IBM is issued with a strike price

Consider the data for IBM options in the table,

LOADING...

. Suppose a new American-style put option on IBM is issued with a strike price of

$130

and an expiration date of December 1st.

a. What is the maximum possible price for this option?

b. What is the minimum possible price for this option?

a. What is the maximum possible price for this option?(Select the best choice below.)

A.No one will pay more than the price of the November option (which expires later), so

$5.55.

B.No one will pay more than the price of the November option (which expires later), so

$9.00.

C.No one will pay more than the price of the November option (which expires later), so

$7.85.

D.No one will pay more than the price of the November option (which expires later), so

$5.40.

122.24 -1.14 IBM (INTL BUSINESS MACHINES) Nov 09 2018 @ 12:01 ET Bid 122.24 Ask 122.26 Size 1 x 2 Vol 2228952 Open Calls Last Sale Net Bid Ask Vol Open Int Puts Last Sale Net Bid Ask Vol Int 7.20 7.40 19 72 0.17 0.06 0.15 0.17 83 2335 3.15 194 605 0.80 0.84 0.88 148 2004 3.00 0.68 0.08 671 0.72 0.11 3407 383 526 0.17 0.72 1.19 2858 4133 3.45 7.98 3.40 7.75 3.55 8.35 40 2837 2018 Nov 16 115.00 (BM1816K115) 7.35 - 1.21 2018 Nov 16 120.00 (BM1816K120) 3.00 -1.20 2018 Nov 16 125.00 (BM1816K125) 0.65 -0.49 2018 Nov 16 130.00 BM1816K130) 0.08 -0.09 2018 Dec 21 115.00 (BM1821L115) 8.90 -1.65 2018 Dec 21 120,00 (IBM1821L120) 5.20 -0.78 2018 Dec 21 125.00 (BM1821L125) 2.59-0.56 2018 Dec 21 130.00 (BM1821L130) 1.12 -0.24 2018 Nov 16 115.00 (BM1816W115) 2018 Nov 16 120.00 IBM18161120) 2018 Nov 16 125.00 IBM1BT6W125) 2018 Nov 16 130.00 (BM1816W130) 2018 Dec 21 115.00 BM1821X115) 2018 Dec 21 120.00 (IBM1821X120) 2018 Dec 21 125.00 (BM1821X125) 2018 Dec 21 130.00 (BM1821X130) 8.85 9.00 8 530 0.27 1.30 1.36 72 2682 5.25 15803 5.35 2.65 77 287 248 14552 7850 1.38 2.75 4.95 8.75 0.49 0.57 2.65 5.05 2.71 5.25 282 65 2.59 7937 1.11 1.18 4491 1.07 8.55 9.00 1 3245 Source: Chicago Board Options Exchange at www.cboe.com 122.24 -1.14 IBM (INTL BUSINESS MACHINES) Nov 09 2018 @ 12:01 ET Bid 122.24 Ask 122.26 Size 1 x 2 Vol 2228952 Open Calls Last Sale Net Bid Ask Vol Open Int Puts Last Sale Net Bid Ask Vol Int 7.20 7.40 19 72 0.17 0.06 0.15 0.17 83 2335 3.15 194 605 0.80 0.84 0.88 148 2004 3.00 0.68 0.08 671 0.72 0.11 3407 383 526 0.17 0.72 1.19 2858 4133 3.45 7.98 3.40 7.75 3.55 8.35 40 2837 2018 Nov 16 115.00 (BM1816K115) 7.35 - 1.21 2018 Nov 16 120.00 (BM1816K120) 3.00 -1.20 2018 Nov 16 125.00 (BM1816K125) 0.65 -0.49 2018 Nov 16 130.00 BM1816K130) 0.08 -0.09 2018 Dec 21 115.00 (BM1821L115) 8.90 -1.65 2018 Dec 21 120,00 (IBM1821L120) 5.20 -0.78 2018 Dec 21 125.00 (BM1821L125) 2.59-0.56 2018 Dec 21 130.00 (BM1821L130) 1.12 -0.24 2018 Nov 16 115.00 (BM1816W115) 2018 Nov 16 120.00 IBM18161120) 2018 Nov 16 125.00 IBM1BT6W125) 2018 Nov 16 130.00 (BM1816W130) 2018 Dec 21 115.00 BM1821X115) 2018 Dec 21 120.00 (IBM1821X120) 2018 Dec 21 125.00 (BM1821X125) 2018 Dec 21 130.00 (BM1821X130) 8.85 9.00 8 530 0.27 1.30 1.36 72 2682 5.25 15803 5.35 2.65 77 287 248 14552 7850 1.38 2.75 4.95 8.75 0.49 0.57 2.65 5.05 2.71 5.25 282 65 2.59 7937 1.11 1.18 4491 1.07 8.55 9.00 1 3245 Source: Chicago Board Options Exchange at www.cboe.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts