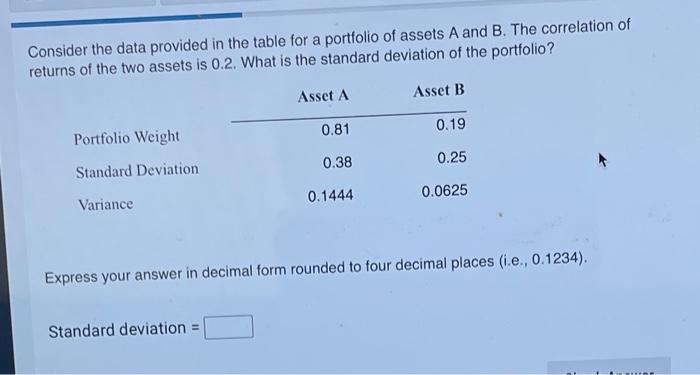

Question: Consider the data provided in the table for a portfolio of assets A and B. The correlation of returns of the two assets is 0.2.

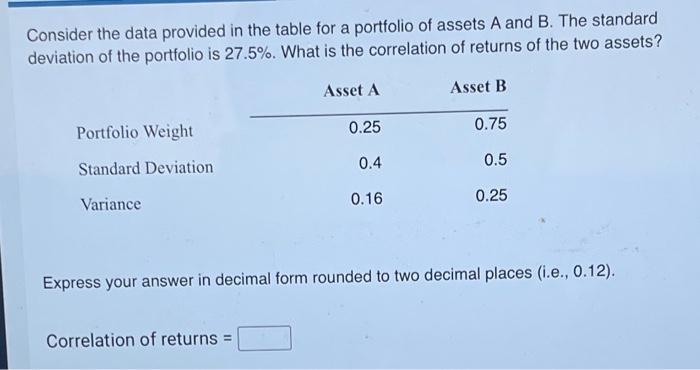

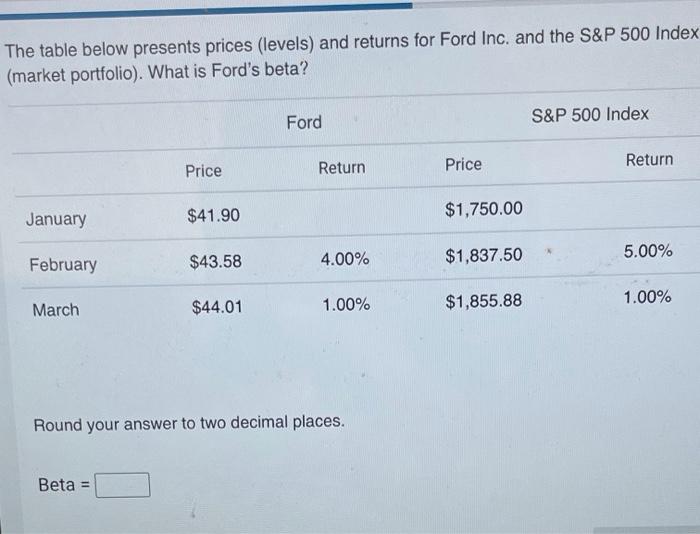

Consider the data provided in the table for a portfolio of assets A and B. The correlation of returns of the two assets is 0.2. What is the standard deviation of the portfolio? Asset A Asset B 0.81 0.19 Portfolio Weight 0.38 0.25 Standard Deviation Variance 0.1444 0.0625 Express your answer in decimal form rounded to four decimal places (.e., 0.1234). Standard deviation = Consider the data provided in the table for a portfolio of assets A and B. The standard deviation of the portfolio is 27.5%. What is the correlation of returns of the two assets? Asset A Asset B 0.25 0.75 Portfolio Weight 0.4 0.5 Standard Deviation Variance 0.16 0.25 Express your answer in decimal form rounded to two decimal places (i.e., 0.12). Correlation of returns = The table below presents prices (levels) and returns for Ford Inc. and the S&P 500 Index (market portfolio). What is Ford's beta? Ford S&P 500 Index Price Return Price Return January $41.90 $1,750.00 $43.58 4.00% 5.00% February $1,837.50 March $44.01 1.00% 1.00% $1,855.88 Round your answer to two decimal places. Beta =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts