Question: Consider the data shown in the table below. The risk free interest rate is 3% and the correlation between two risky stocks is -0.4. Suppose,

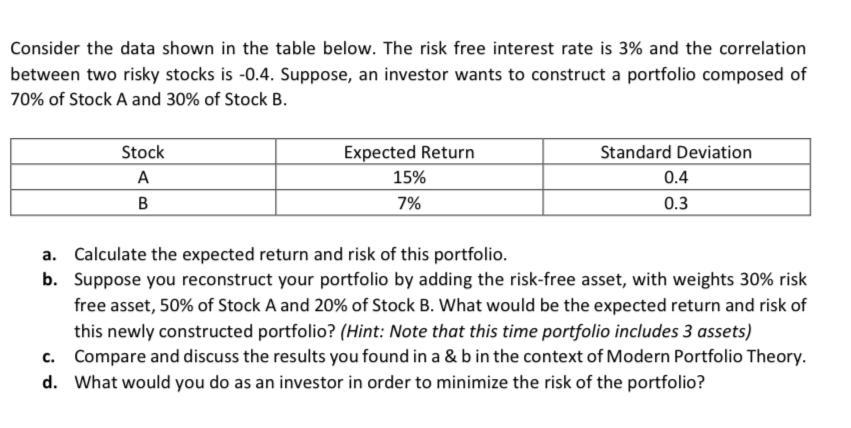

Consider the data shown in the table below. The risk free interest rate is 3% and the correlation between two risky stocks is -0.4. Suppose, an investor wants to construct a portfolio composed of 70% of Stock A and 30% of Stock B. Stock A B Expected Return 15% Standard Deviation 0.4 0.3 7% a. Calculate the expected return and risk of this portfolio. b. Suppose you reconstruct your portfolio by adding the risk-free asset, with weights 30% risk free asset, 50% of Stock A and 20% of Stock B. What would be the expected return and risk of this newly constructed portfolio? (Hint: Note that this time portfolio includes 3 assets) c. Compare and discuss the results you found in a & b in the context of Modern Portfolio Theory. d. What would you do as an investor in order to minimize the risk of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts