Question: Consider the Diamond and Dybvig model we studied in Topic 7: Suppose there are N=100 households with utility U(C)=1eC endowed with one unit of the

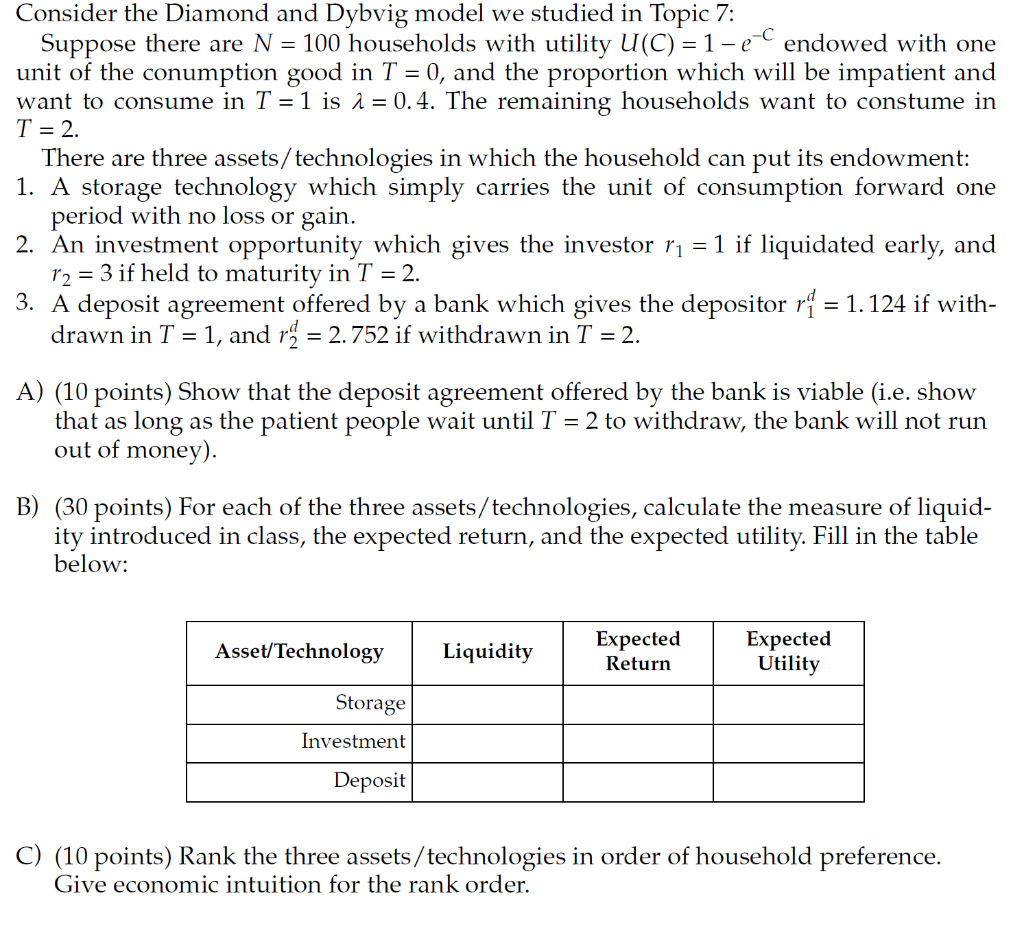

Consider the Diamond and Dybvig model we studied in Topic 7: Suppose there are N=100 households with utility U(C)=1eC endowed with one unit of the conumption good in T=0, and the proportion which will be impatient and want to consume in T=1 is =0.4. The remaining households want to constume in T=2. There are three assets/technologies in which the household can put its endowment: 1. A storage technology which simply carries the unit of consumption forward one period with no loss or gain. 2. An investment opportunity which gives the investor r1=1 if liquidated early, and r2=3 if held to maturity in T=2. 3. A deposit agreement offered by a bank which gives the depositor r1d=1.124 if withdrawn in T=1, and r2d=2.752 if withdrawn in T=2. A) (10 points) Show that the deposit agreement offered by the bank is viable (i.e. show that as long as the patient people wait until T=2 to withdraw, the bank will not run out of money). B) (30 points) For each of the three assets/technologies, calculate the measure of liquidity introduced in class, the expected return, and the expected utility. Fill in the table below: C) (10 points) Rank the three assets/technologies in order of household preference. Give economic intuition for the rank order. Consider the Diamond and Dybvig model we studied in Topic 7: Suppose there are N=100 households with utility U(C)=1eC endowed with one unit of the conumption good in T=0, and the proportion which will be impatient and want to consume in T=1 is =0.4. The remaining households want to constume in T=2. There are three assets/technologies in which the household can put its endowment: 1. A storage technology which simply carries the unit of consumption forward one period with no loss or gain. 2. An investment opportunity which gives the investor r1=1 if liquidated early, and r2=3 if held to maturity in T=2. 3. A deposit agreement offered by a bank which gives the depositor r1d=1.124 if withdrawn in T=1, and r2d=2.752 if withdrawn in T=2. A) (10 points) Show that the deposit agreement offered by the bank is viable (i.e. show that as long as the patient people wait until T=2 to withdraw, the bank will not run out of money). B) (30 points) For each of the three assets/technologies, calculate the measure of liquidity introduced in class, the expected return, and the expected utility. Fill in the table below: C) (10 points) Rank the three assets/technologies in order of household preference. Give economic intuition for the rank order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts