Question: Consider the equity issuance problem discussed in the final two slides of chapter 4, in the pecking order part. We showed that if the probability

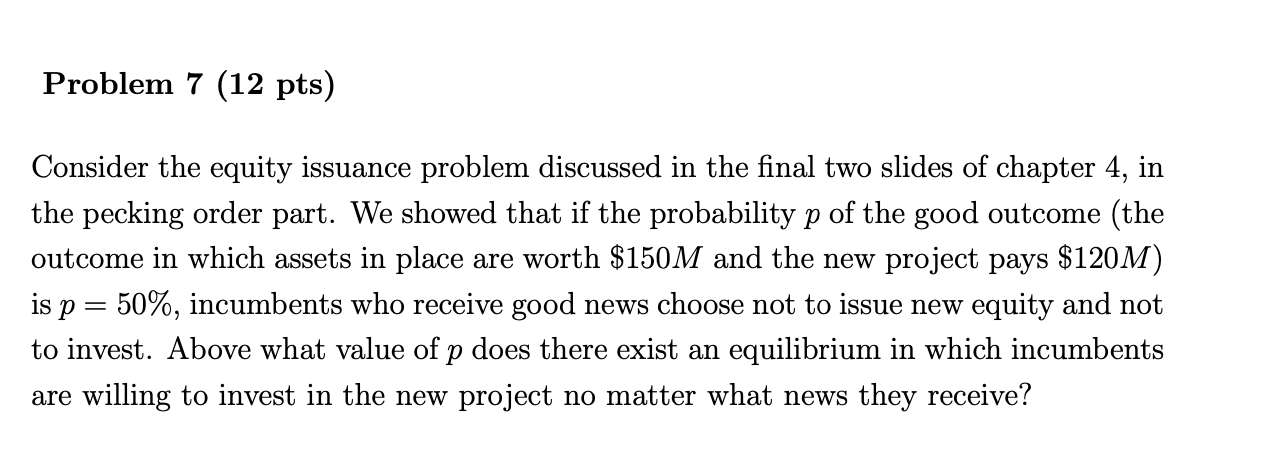

Consider the equity issuance problem discussed in the final two slides of chapter 4, in the pecking order part. We showed that if the probability p of the good outcome (the outcome in which assets in place are worth $150M and the new project pays $120M) is p = 50%, incumbents who receive good news choose not to issue new equity and not to invest. Above what value of p does there exist an equilibrium in which incumbents are willing to invest in the new project no matter what news they receive?

Consider the equity issuance problem discussed in the final two slides of chapter 4, in the pecking order part. We showed that if the probability p of the good outcome (the outcome in which assets in place are worth $150M and the new project pays $120M) is p = 50%, incumbents who receive good news choose not to issue new equity and not to invest. Above what value of p does there exist an equilibrium in which incumbents are willing to invest in the new project no matter what news they receive?

Problem 7 (12 pts) Consider the equity issuance problem discussed in the final two slides of chapter 4, in the pecking order part. We showed that if the probability p of the good outcome (the outcome in which assets in place are worth $150M and the new project pays $120M) is p = 50%, incumbents who receive good news choose not to issue new equity and not to invest. Above what value of p does there exist an equilibrium in which incumbents are willing to invest in the new project no matter what news they receive? Problem 7 (12 pts) Consider the equity issuance problem discussed in the final two slides of chapter 4, in the pecking order part. We showed that if the probability p of the good outcome (the outcome in which assets in place are worth $150M and the new project pays $120M) is p = 50%, incumbents who receive good news choose not to issue new equity and not to invest. Above what value of p does there exist an equilibrium in which incumbents are willing to invest in the new project no matter what news they receive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts