Question: Consider the exchange rate between the U.S. $ and the U.K. pound. Suppose the exchange rate E* is defined as pound/$. (a) Denote the one-year

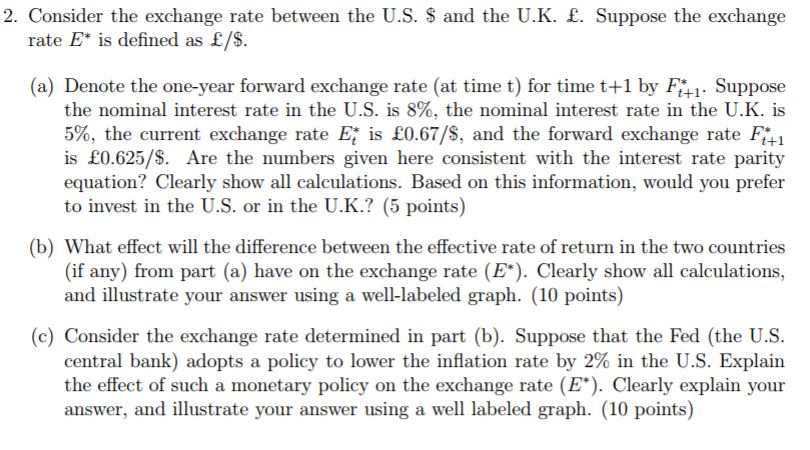

Consider the exchange rate between the U.S. $ and the U.K. pound. Suppose the exchange rate E* is defined as pound/$. (a) Denote the one-year forward exchange rate (at time t) for time t+1 by F*_t+1. Suppose the nominal interest rate in the U.S. is 8%. the nominal interest rate in the U.K. is 5%, the current exchange rate E_t* is pound 0.67/$, and the forward exchange rate Ft*_t+1 is pound 0.625/$. Are the numbers given here consistent with the interest rate parity equation? Clearly show all calculations. Based on this information, would you prefer to invest in the U.S. or in the U.K.? (b) What effect will the difference between the effective rate of return in the two countries (if any) from part (a) have on the exchange rate (E*). Clearly show all calculations, and illustrate your answer using a well-labeled graph. (c) Consider the exchange rate determined in part (b). Suppose that the Fed (the U.S. central bank) adopts a policy to lower the inflation rate by 2% in the U.S. Explain the effect of such a monetary policy on the exchange rate (E*). Clearly explain your answer, and illustrate your answer using a well labeled graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts