Question: Consider the expected returns and standard deviations below for a 20 US Treasury Bond ETF and an ETF based on near-dated Bitcoin futures. The correlation

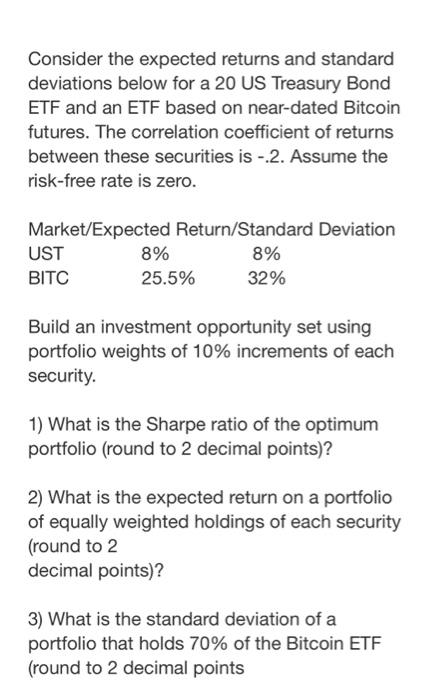

Consider the expected returns and standard deviations below for a 20 US Treasury Bond ETF and an ETF based on near-dated Bitcoin futures. The correlation coefficient of returns between these securities is - 2. Assume the risk-free rate is zero. Market/Expected Return/Standard Deviation UST 8% 8% BITC 25.5% 32% Build an investment opportunity set using portfolio weights of 10% increments of each security. 1) What is the Sharpe ratio of the optimum portfolio (round to 2 decimal points)? 2) What is the expected return on a portfolio of equally weighted holdings of each security (round to 2 decimal points)? 3) What is the standard deviation of a portfolio that holds 70% of the Bitcoin (round to 2 decimal points TF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts