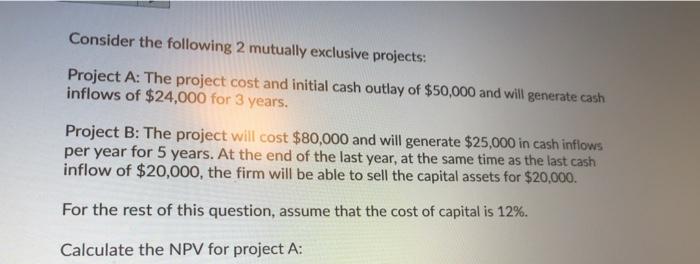

Question: Consider the following 2 mutually exclusive projects: Project A: The project cost and initial cash outlay of $50,000 and will generate cash inflows of $24,000

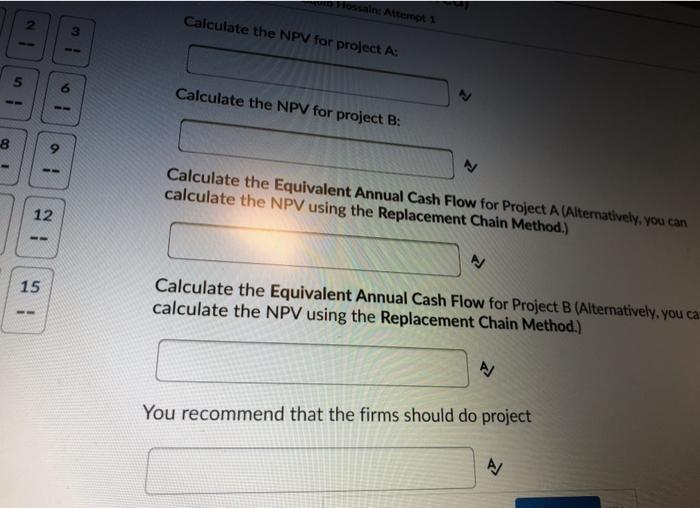

Consider the following 2 mutually exclusive projects: Project A: The project cost and initial cash outlay of $50,000 and will generate cash inflows of $24,000 for 3 years. Project B: The project will cost $80,000 and will generate $25,000 in cash inflows per year for 5 years. At the end of the last year, at the same time as the last cash inflow of $20,000, the firm will be able to sell the capital assets for $20,000. For the rest of this question, assume that the cost of capital is 12%. Calculate the NPV for project A: ostain: Attempt 1 Calculate the NPV for project A: 3 5 I a Calculate the NPV for project B: 8 Calculate the Equivalent Annual Cash Flow for Project A (Alternatively, you can calculate the NPV using the Replacement Chain Method.) 12 15 Calculate the Equivalent Annual Cash Flow for Project B (Alternatively, you ca calculate the NPV using the Replacement Chain Method.) -- You recommend that the firms should do project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts