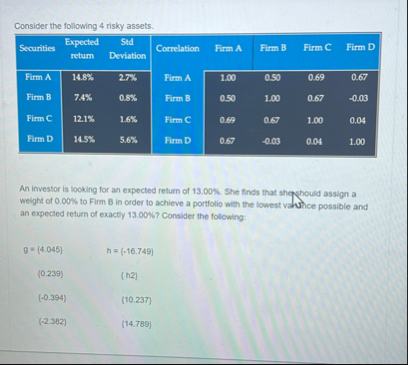

Question: Consider the following 4 risky assets. table [ [ Scourtics , Expected return, table [ [ Std ] , [ Deviation ] ]

Consider the following risky assets.

tableScourticsExpected return,tableStdDeviationCorrelation,Firm AFirm BFirm Cfirm DFirm AFirm AFirm BFirm BFirm CFirme,Firm DFirm D

An investor is looking for an expected return of She finds that shophould assign a weight of to Firm B in order to achieve a portfolio with the lowest vahthce possible and an expected feturn of exactly Consider the following:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock