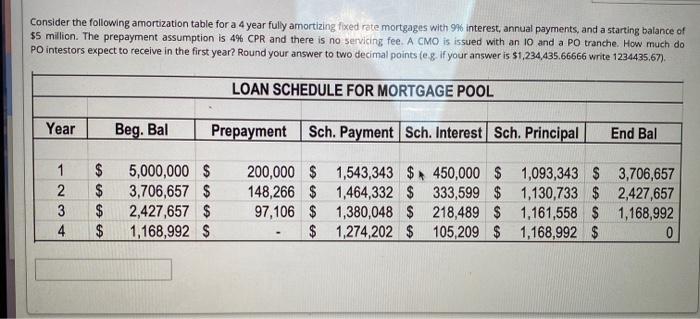

Question: Consider the following amortization table for a 4 year fully amortizing fixed rate mortgages with 9% interest, annual payments, and a starting balance of $5

Consider the following amortization table for a 4 year fully amortizing fixed rate mortgages with 9% interest, annual payments, and a starting balance of $5 million. The prepayment assumption is 4% CPR and there is no servicing fee. A CMO is issued with an 10 and a PO tranche. How much do PO intestors expect to receive in the first year? Round your answer to two decimal points (eg. if your answer is $1,234,435.66666 write 1234435.67). LOAN SCHEDULE FOR MORTGAGE POOL Year Beg. Bal Prepayment Sch. Payment Sch. Interest Sch. Principal End Bal 1 2 3 4 $ $ $ $ 5,000,000 $ 3,706,657 $ 2,427,657 $ 1,168,992 $ 200,000 $ 1,543,343 $ 450,000 $ 1,093,343 $ 3,706,657 148,266 $ 1,464,332 $ 333,599 $ 1,130,733 $ 2,427,657 97,106 $ 1,380,048 $ 218,489 $ 1,161,558 $ 1,168,992 $ 1,274,202 $ 105,209 $ 1,168,992 $ 0 Consider the following amortization table for a 4 year fully amortizing fixed rate mortgages with 9% interest, annual payments, and a starting balance of $5 million. The prepayment assumption is 4% CPR and there is no servicing fee. A CMO is issued with an 10 and a PO tranche. How much do PO intestors expect to receive in the first year? Round your answer to two decimal points (eg. if your answer is $1,234,435.66666 write 1234435.67). LOAN SCHEDULE FOR MORTGAGE POOL Year Beg. Bal Prepayment Sch. Payment Sch. Interest Sch. Principal End Bal 1 2 3 4 $ $ $ $ 5,000,000 $ 3,706,657 $ 2,427,657 $ 1,168,992 $ 200,000 $ 1,543,343 $ 450,000 $ 1,093,343 $ 3,706,657 148,266 $ 1,464,332 $ 333,599 $ 1,130,733 $ 2,427,657 97,106 $ 1,380,048 $ 218,489 $ 1,161,558 $ 1,168,992 $ 1,274,202 $ 105,209 $ 1,168,992 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts