Question: Consider the following APT model, which describes how excess returns on a portfolio are explained by the portfolio's return sensitivity to N risk factors. The

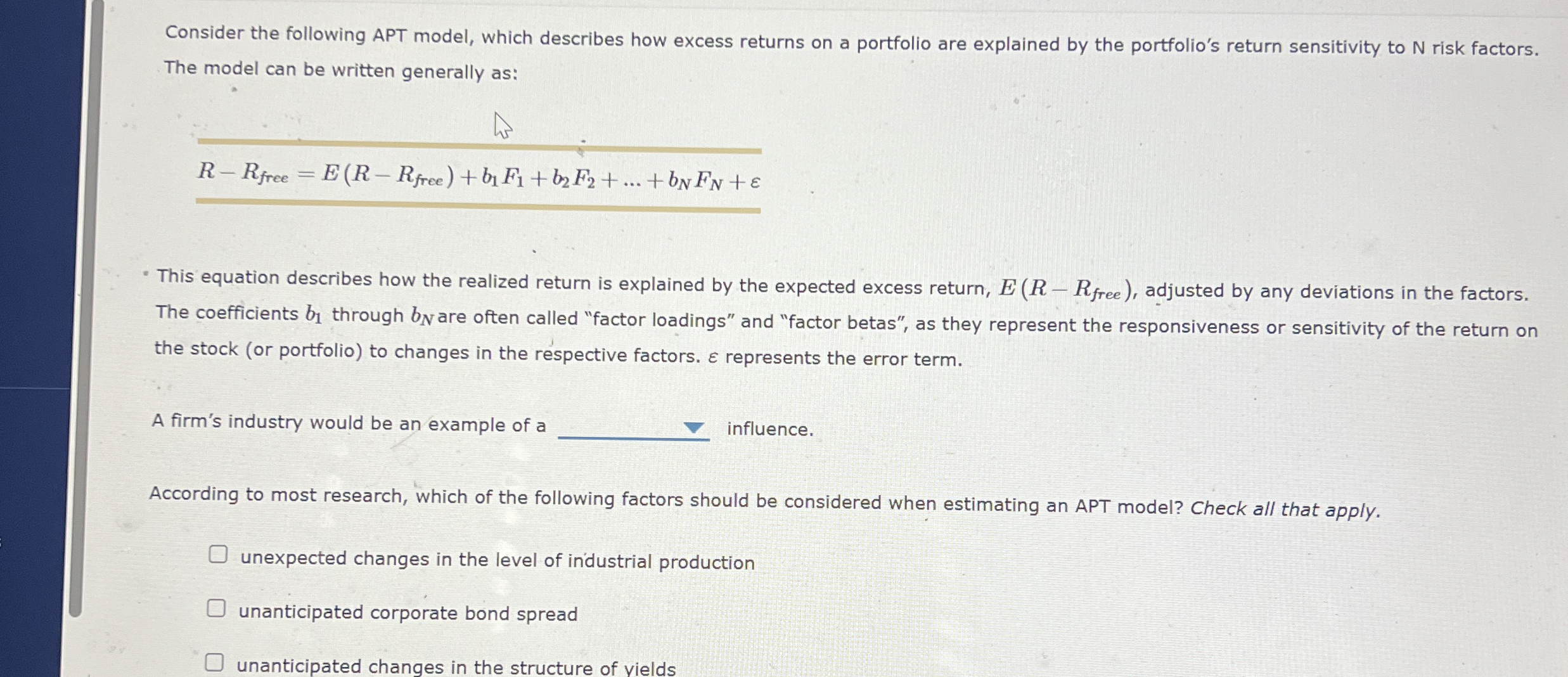

Consider the following APT model, which describes how excess returns on a portfolio are explained by the portfolio's return sensitivity to N risk factors.

The model can be written generally as:

dots

This equation describes how the realized return is explained by the expected excess return, adjusted by any deviations in the factors.

The coefficients through are often called "factor loadings" and "factor betas", as they represent the responsiveness or sensitivity of the return on

the stock or portfolio to changes in the respective factors. represents the error term.

A firm's industry would be an example of a

influence.

According to most research, which of the following factors should be considered when estimating an APT model? Check all that apply.

unexpected changes in the level of industrial production

unanticipated corporate bond spread

unanticipated changes in the structure of yields

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock