Question: Consider the following assets whose returns depend on whether the highly credible health and safety experts will coerce individuals into being injected with either three

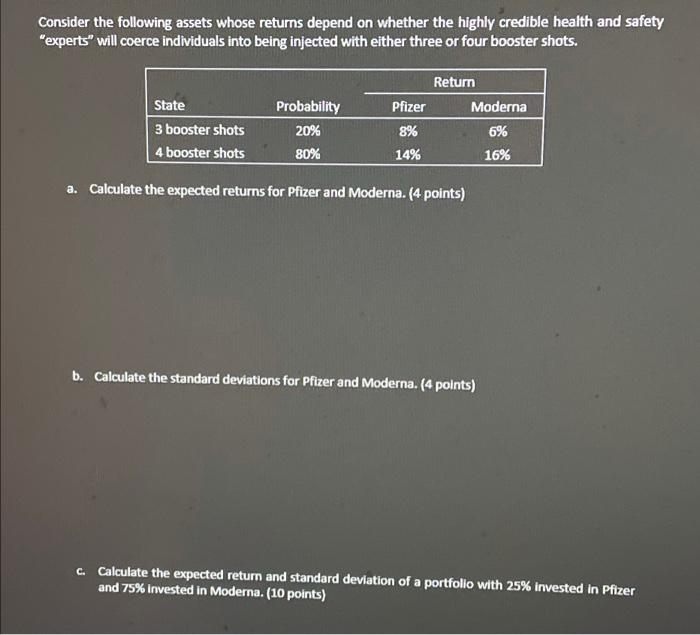

Consider the following assets whose returns depend on whether the highly credible health and safety "experts will coerce individuals into being injected with either three or four booster shots. Pfizer State 3 booster shots 4 booster shots Probability 20% Return Moderna 6% 8% 14% 80% 16% a. Calculate the expected returns for Pfizer and Moderna. (4 points) b. Calculate the standard deviations for Pfizer and Moderna. (4 points) c. Calculate the expected return and standard deviation of a portfolio with 25% invested in Pfizer and 75% invested in Moderna. (10 points) d. Calculate the Sharpe ratio of the portfolio from part (c) if the risk-free rate is 1%. (4 points) e Suppose the portfolio from part (c) is on the efficient frontier. Holding the standard deviation of the portfolio constant, can you form a better portfolio comprising only Pfizer and Moderna? Explain why or why not. Be BRIEF. No calculations required. (Hint: a picture might be helpful in explaining your answer but is not necessary.) (4 points) I f. Again, suppose the portfolio from part (c) is on the efficient frontier. Holding the standard deviation of the portfolio constant, can you form a better portfolio comprising Pfizer, Moderna, and a risk-free asset? Explain why or why not. Be BRIEF. No calculations required. (Hint: a picture might be helpful in explaining your answer but is not necessary.) (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts