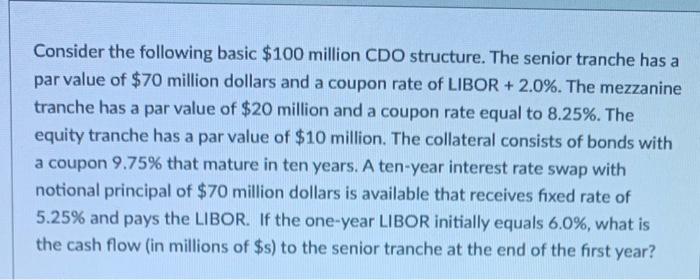

Question: Consider the following basic $100 million CDO structure. The senior tranche has a par value of $70 million dollars and a coupon rate of LIBOR

Consider the following basic $100 million CDO structure. The senior tranche has a par value of $70 million dollars and a coupon rate of LIBOR + 2.0%. The mezzanine tranche has a par value of $20 million and a coupon rate equal to 8.25%. The equity tranche has a par value of $10 million. The collateral consists of bonds with a coupon 9.75% that mature in ten years. A ten-year interest rate swap with notional principal of $70 million dollars is available that receives fixed rate of 5.25% and pays the LIBOR. If the one-year LIBOR initially equals 6.0%, what is the cash flow (in millions of $s) to the senior tranche at the end of the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts