Question: Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles will be option prices (# numbers are the exercise

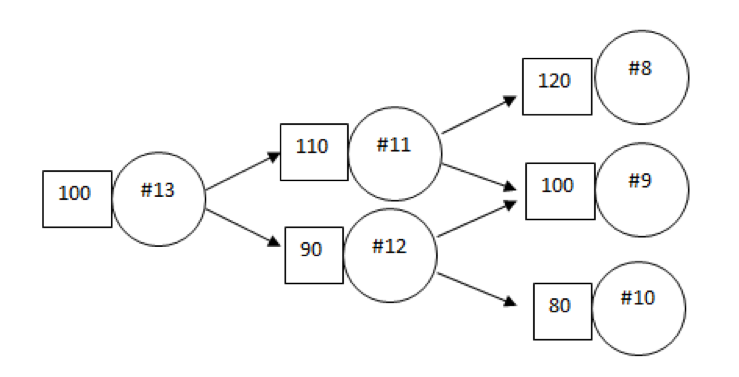

Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles will be option prices (# numbers are the exercise numbers to answer your calculation). Today, the stock is at 100 and can go up and down over the next week, and then again up and down from there. We are pricing a call struck at 90. Use the computed q to sweep back through the tree to fill the call values in circles. For each node use the formula: C = q Cu + (1-q) Cd. Ignore interest.

Q7: Compute the probability of the up-step: q =

Q8: #8 Call Value =

Q9: #9 Call Value =

Q10: #10 Call Value =

Q11: #11 Call Value =

Q12: #12 Call Value =

Q13: #13 Todays Call Value=

Q14: Exercise #14. Today, the delta (hedge ratio) is Cu-C A = Su-S

Q15: Exercise #15. Todays call premium is: $______

Q16:Exercise #16. Interpret the delta. If you sell a call option on one hundred shares, the delta hedge will require you to buy _______________ shares of stock (how many?).

#8 120 110 #11 100 / #9 #13 100 #12 80 #10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts