Question: Consider the following case: Franklin Aerospace has a quick ratio of 2.00x, $29,475 in cash, $16,375 in accounts receivable, some inventory, total current assets of

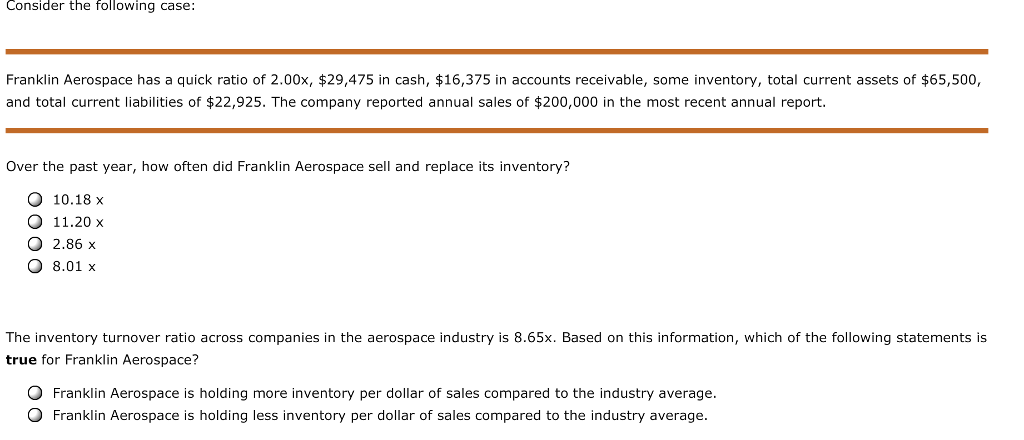

Consider the following case: Franklin Aerospace has a quick ratio of 2.00x, $29,475 in cash, $16,375 in accounts receivable, some inventory, total current assets of $65,500, and total current liabilities of $22,925. The company reported annual sales of $200,000 in the most recent annual report. Over the past year, how often did Franklin Aerospace sell and replace its inventory? 10.18 O 11.20 x O 2.86 x O 8.01 x The inventory turnover ratio across companies in the aerospace industry is 8.65x. Based on this information, which of the following statements is true for Franklin Aerospace? O Franklin Aerospace is holding more inventory per dollar of sales compared to the industry average O Franklin Aerospace is holding less inventory per dollar of sales compared to the industry average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts