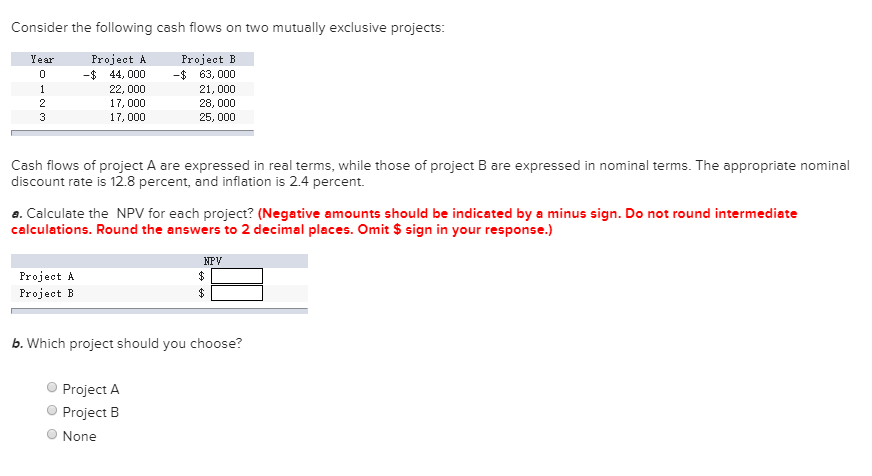

Question: Consider the following cash flows on two mutually exclusive projects: Year 0 1 Project A -$ 44,000 22,000 17,000 17,000 Project B -$ 63,000 21,000

Consider the following cash flows on two mutually exclusive projects: Year 0 1 Project A -$ 44,000 22,000 17,000 17,000 Project B -$ 63,000 21,000 28,000 25,000 2 3 Cash flows of project A are expressed in real terms, while those of project B are expressed in nominal terms. The appropriate nominal discount rate is 12.8 percent, and inflation is 2.4 percent. a. Calculate the NPV for each project? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round the answers to 2 decimal places. Omit $ sign in your response.) Project A Project B NPV $ $ b. Which project should you choose? Project A Project B None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts