Question: Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation (BRC). Both projects require an annual return of 16 percent.

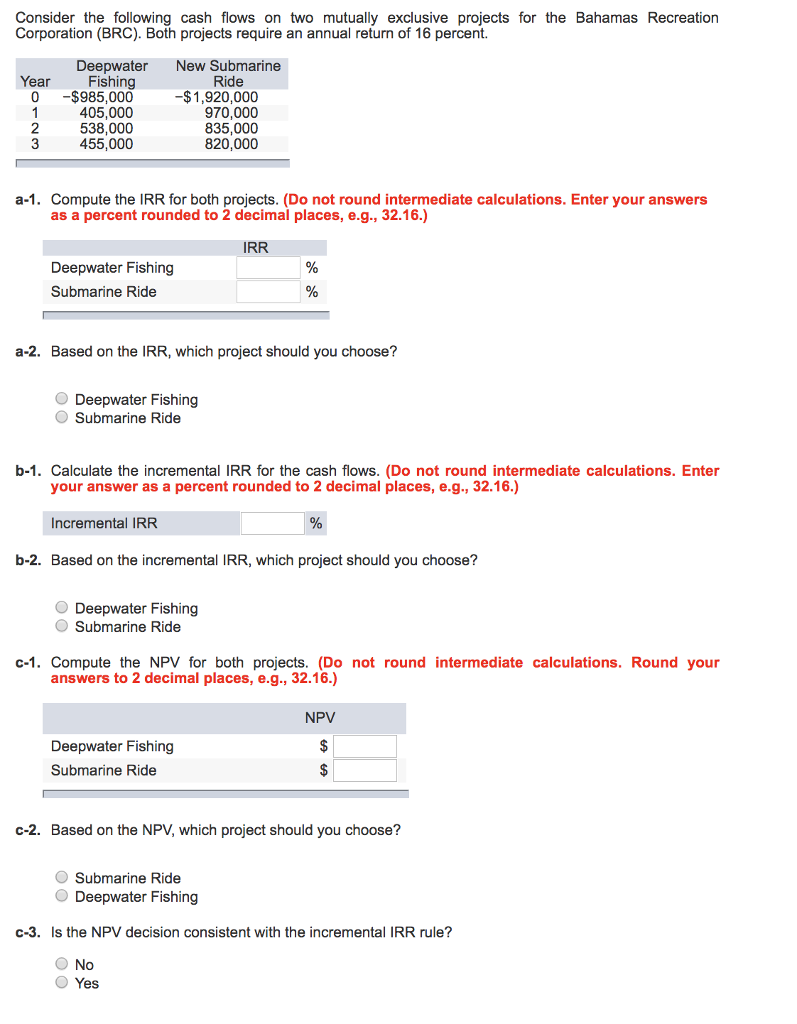

Consider the following cash flows on two mutually exclusive projects for the Bahamas Recreation Corporation (BRC). Both projects require an annual return of 16 percent. Deepwater New Submarine Fishing 0 $985,000 405,000 538,000 455,000 Year Ride -$1,920,000 970,000 835,000 820,000 2 a-1. Compute the IRR for both projects. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) IRR Deepwater Fishing Submarine Ride a-2. Based on the IRR, which project should you choose? Deepwater Fishing O Submarine Ride b-1. Calculate the incremental IRR for the cash flows. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Incremental IRR b-2. Based on the incremental IRR, which project should you choose? Deepwater Fishing O Submarine Ride c-1. Compute the NPV for both projects. (Do not round intermediate calculations. Round your answers to 2 decimal places, e.g., 32.16.) NPV Deepwater Fishing Submarine Ride c-2. Based on the NPV, which project should you choose? O Submarine Ride Deepwater Fishing c-3. Is the NPV decision consistent with the incremental IRR rule? O No O Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts