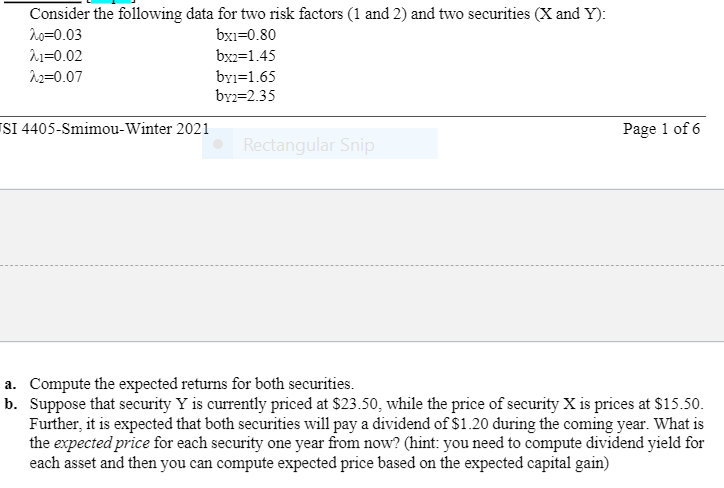

Question: Consider the following data for two risk factors (1 and 2) and two securities (X and Y): 20=0.03 bx1=0.80 2.1=0.02 bx2=1.45 2.2=0.07 byi=1.65 by2=2.35 SI

Consider the following data for two risk factors (1 and 2) and two securities (X and Y): 20=0.03 bx1=0.80 2.1=0.02 bx2=1.45 2.2=0.07 byi=1.65 by2=2.35 SI 4405-Smimou-Winter 2021 Rectangular Snip Page 1 of 6 a. Compute the expected returns for both securities. b. Suppose that security Y is currently priced at $23.50, while the price of security X is prices at $15.50. Further, it is expected that both securities will pay a dividend of $1.20 during the coming year. What is the expected price for each security one year from now? (hint: you need to compute dividend yield for each asset and then you can compute expected price based on the expected capital gain) Consider the following data for two risk factors (1 and 2) and two securities (X and Y): 20=0.03 bx1=0.80 2.1=0.02 bx2=1.45 2.2=0.07 byi=1.65 by2=2.35 SI 4405-Smimou-Winter 2021 Rectangular Snip Page 1 of 6 a. Compute the expected returns for both securities. b. Suppose that security Y is currently priced at $23.50, while the price of security X is prices at $15.50. Further, it is expected that both securities will pay a dividend of $1.20 during the coming year. What is the expected price for each security one year from now? (hint: you need to compute dividend yield for each asset and then you can compute expected price based on the expected capital gain)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts