Question: Consider the following data relating to macroeconomic variables and the returns on a stock, ErGas, Inc. evaluated using the Arbitrage Pricing Theory model of risk

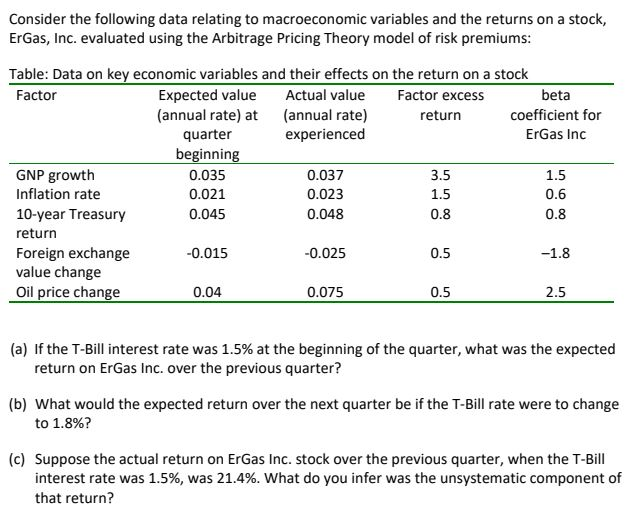

Consider the following data relating to macroeconomic variables and the returns on a stock, ErGas, Inc. evaluated using the Arbitrage Pricing Theory model of risk premiums: Table: Data on key economic variables and their effects on the return on a stock Factor Expected value Actual value Factor excess beta (annual rate) at (annual rate) return coefficient for quarter experienced ErGas Inc beginning GNP growth 0.035 0.037 1.5 Inflation rate 0.021 0.023 10-year Treasury 0.045 0.048 0.8 0.8 return Foreign exchange -0.015 -0.025 value change Oil price change 0.075 1.5 0.6 0 0.04 2.5 (a) If the T-Bill interest rate was 1.5% at the beginning of the quarter, what was the expected return on ErGas Inc. over the previous quarter? (b) What would the expected return over the next quarter be if the T-Bill rate were to change to 1.8%? (c) Suppose the actual return on ErGas Inc. stock over the previous quarter, when the T-Bill interest rate was 1.5%, was 21.4%. What do you infer was the unsystematic component of that return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts