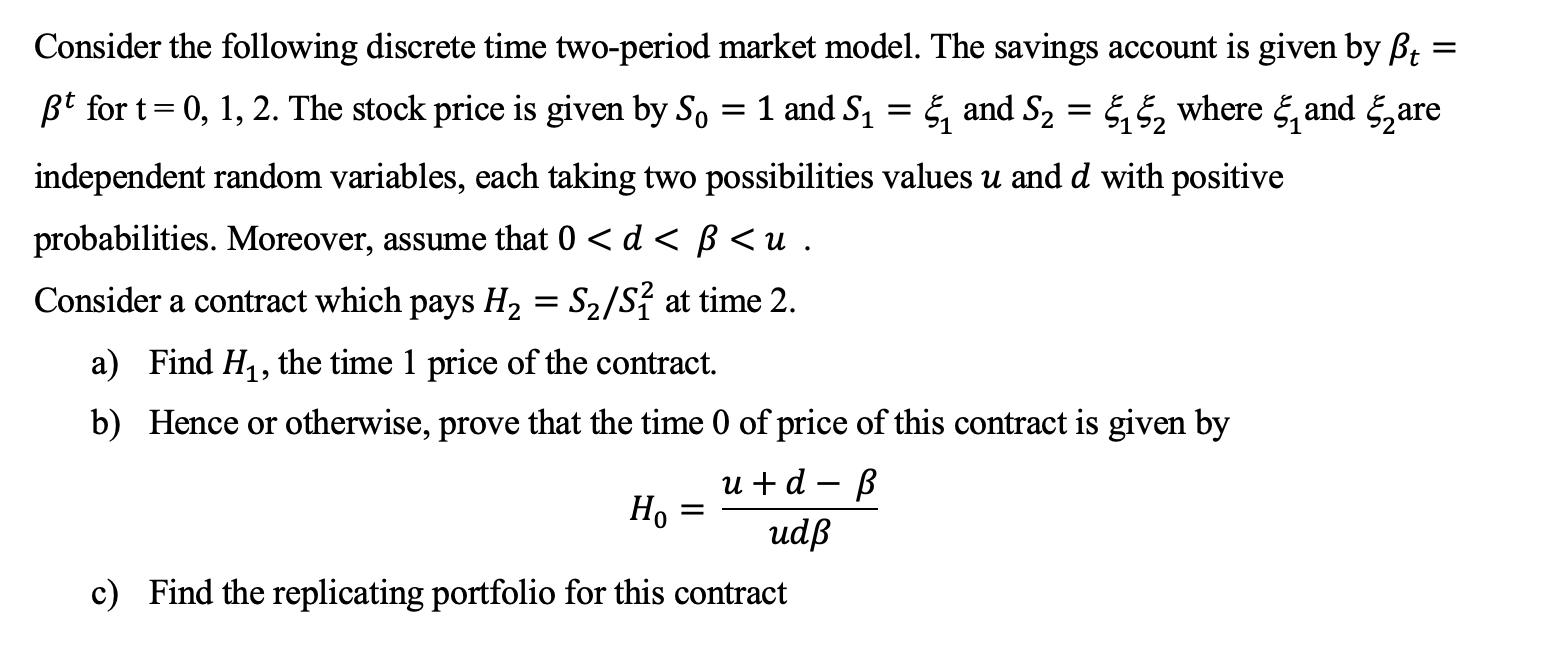

= Consider the following discrete time two-period market model. The savings account is given by t...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

= Consider the following discrete time two-period market model. The savings account is given by t ₁5₂ 5₁5₂ where and are 51 ßt for t= 0, 1, 2. The stock price is given by So = 1 and S₁ = ₁ and S₂ = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < ß < u . Consider a contract which pays H₂ = S₂/S² at time 2. a) Find H₁, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d В Ho c) Find the replicating portfolio for this contract = udp = Consider the following discrete time two-period market model. The savings account is given by t ₁5₂ 5₁5₂ where and are 51 ßt for t= 0, 1, 2. The stock price is given by So = 1 and S₁ = ₁ and S₂ = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < ß < u . Consider a contract which pays H₂ = S₂/S² at time 2. a) Find H₁, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d В Ho c) Find the replicating portfolio for this contract = udp = Consider the following discrete time two-period market model. The savings account is given by t ₁5₂ 5₁5₂ where and are 51 ßt for t= 0, 1, 2. The stock price is given by So = 1 and S₁ = ₁ and S₂ = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < ß < u . Consider a contract which pays H₂ = S₂/S² at time 2. a) Find H₁, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d В Ho c) Find the replicating portfolio for this contract = udp = Consider the following discrete time two-period market model. The savings account is given by t ₁5₂ 5₁5₂ where and are 51 ßt for t= 0, 1, 2. The stock price is given by So = 1 and S₁ = ₁ and S₂ = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < ß < u . Consider a contract which pays H₂ = S₂/S² at time 2. a) Find H₁, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d В Ho c) Find the replicating portfolio for this contract = udp

Expert Answer:

Answer rating: 100% (QA)

a To find the time 1 price of the contract we need to find the expected value of H2 discounted back ... View the full answer

Related Book For

Posted Date:

Students also viewed these mathematics questions

-

Consider the following discrete probability distribution: Outcome Probability 10 0.10 15 0.30 20 0.20 25 0.30 30 0.10 a. Calculate the mean of this distribution. b. Calculate the standard...

-

Consider the following discrete probability distribution: x P(x) 3.0.13 6.0.12 90.15 12..0.60 a. Calculate the variance and standard deviation of the random variable. b. Let y = x + 7. Calculate the...

-

Consider the following discrete probability distribution: x P(x) 5..0.10 10..0.15 15..0.25 20..0.50 a. Calculate the expected value of the random variable. b. Let y = x + 5. Calculate the expected...

-

A palindrome is a string that is the same backward as it is forward. For example,tot and otto are rather short palindromes. Write a program that lets a user enter a string and that passes to a bool...

-

Thomas worked at a Sherwin-Williams paint store that James managed. Thomas and James had a falling out when, according to Thomas, "a relationship began to bloom between Thomas and one of the young...

-

(a) Identify the three activities that pertain to a petty cash fund, and indicate an internal control principle that is applicable to each activity. (b) When are journal entries required in the...

-

Consider a strategy of the form \((\gamma, 0,0)\) for the investment wheel. Show that the overall factor multiplying your money after \(n\) steps is likely to be \((1+2 \gamma)^{n / 2}(1-\gamma)^{n /...

-

Data Set 9 in Appendix B lists measured cotinine levels from a sample of subjects who smoke, another sample of subjects who do not smoke but are exposed to environmental tobacco smoke, and a third...

-

Instructions Job Cost, Source Documents Spade Millhone Detective Agency performs investigative work for a variety of clients. Recently, Alban Insurance Company asked Spade Millhone to investigate a...

-

Use the superposition principle to find io and vo in the circuit Fig. 4.79? Figure 4.79 For Prob. 4.11. 10 10 20 6 A 40 4 +30 V 10

-

Use the following financial statement information available for Jones Corporation 2012 2011 Net sales $784,000 $697,000 Cost of goods sold 406,000 377,000 Net income 112,000 80,000 Tax expense...

-

The company you work for is considering building a new warehouse and manufacturing facility. The cost of the new buildings will be $6.9 million. Your manager wants you to decide how the company...

-

Arguing in the affirmative. Topic: It is ethically appropriate for police and other government authorities to use Covid app data to help solve crimes. Identifies three major distinct arguments...

-

Conduct research on existing/new 'Diversity Management' programs or initiatives in order that your team has a good understanding of how best to prepare your report/presentation. Discuss as a group...

-

Barney Draper (Draper) has been with the Surrey location for the past fifteen years, working in the warehouse. He started as a warehouse aid and was promoted to warehouse supervisor over the years....

-

Share your perspective on whether you think there are problems in this world that cannot be solved despite the best efforts of human services practitioners. Provide an example. Explain whether it...

-

According to the regression analysis, estiThe following data will help answer questions 1 to 5: XYZ Co. produces one product. The following data shows the number of units of product made in the last...

-

r = 0.18 Find the coefficients of determination and non-determination and explain the meaning of each.

-

The IRS reported that 81% of individual tax returns were filed electronically in 2012. A random sample of 225 tax returns from 2013 was selected. From this sample, 176 were filed electronically. a....

-

The Excel file titled gasoline prices.xlsx lists the average monthly price per gallon of regular gasoline in the United States from August 1990 to January 2013 from the U.S. Energy Information...

-

Nick sells live Christmas trees each year beginning in late November. He needs to place an order for the Douglas fir variety in early fall from the tree farm. Nick is deciding whether to order 100,...

-

Suppose that in September 2013 a company takes a long position in a contract on May 2014 crude oil futures. It closes out its position in March 2014. The futures price (per barrel) is \($88.30\) when...

-

Explain how the control variate technique is implemented.

-

A company wishes to hedge its exposure to a new fuel whose price changes have a 0.6 correlation with gasoline futures price changes. The company will lose $1 million for each 1 cent increase in the...

Study smarter with the SolutionInn App