Question: Consider the following equation (a discretized Vasicek model) for generating successive spot interest rates: r(t+t)=r(t)+(rr(t))t+W(0,t), where r(t) is the spot rate at time t, and

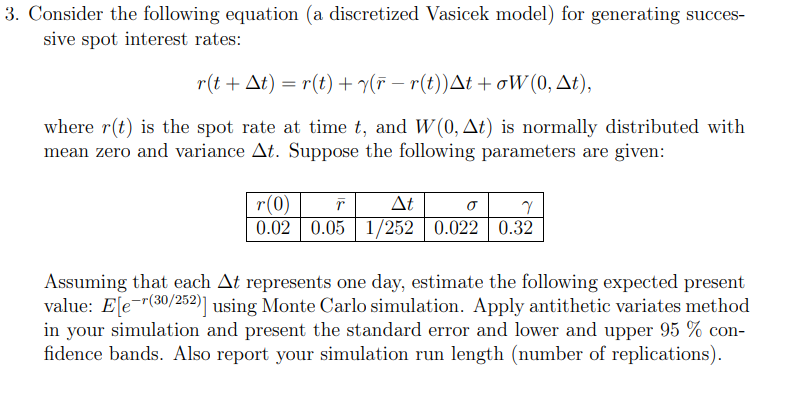

Consider the following equation (a discretized Vasicek model) for generating successive spot interest rates: r(t+t)=r(t)+(rr(t))t+W(0,t), where r(t) is the spot rate at time t, and W(0,t) is normally distributed with mean zero and variance t. Suppose the following parameters are given: Assuming that each t represents one day, estimate the following expected present value: E[er(30/252)] using Monte Carlo simulation. Apply antithetic variates method in your simulation and present the standard error and lower and upper 95% confidence bands. Also report your simulation run length (number of replications). Consider the following equation (a discretized Vasicek model) for generating successive spot interest rates: r(t+t)=r(t)+(rr(t))t+W(0,t), where r(t) is the spot rate at time t, and W(0,t) is normally distributed with mean zero and variance t. Suppose the following parameters are given: Assuming that each t represents one day, estimate the following expected present value: E[er(30/252)] using Monte Carlo simulation. Apply antithetic variates method in your simulation and present the standard error and lower and upper 95% confidence bands. Also report your simulation run length (number of replications)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts