Question: Consider the following equipment replacement problem discussed in Section 5-3 of this chapter. wants to replace his equipment at least every 2 years. year old

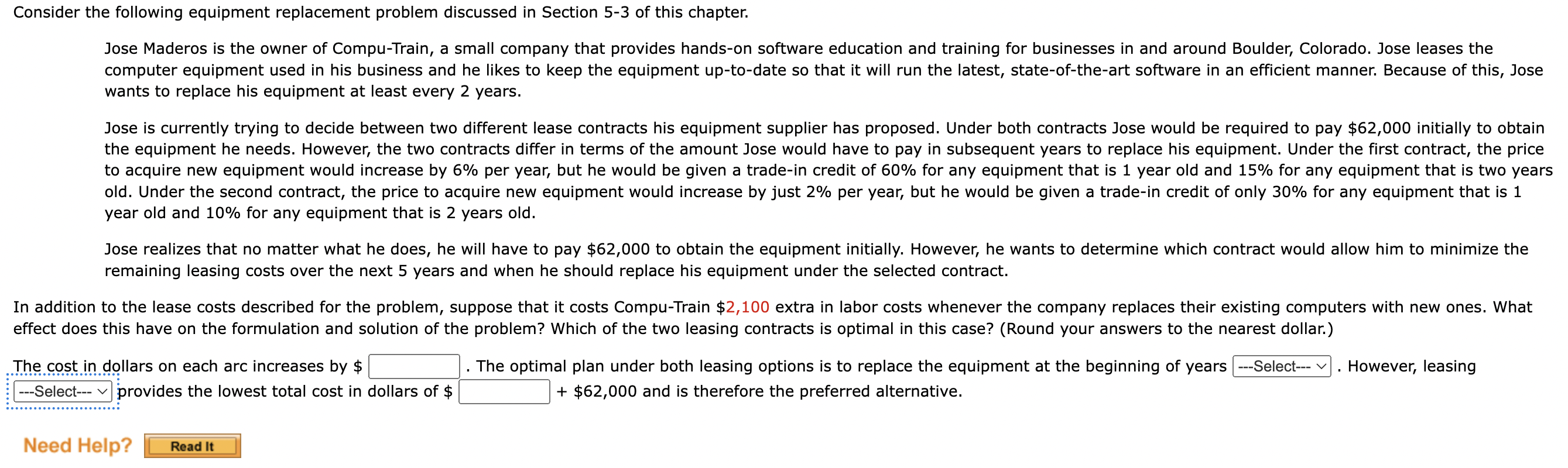

Consider the following equipment replacement problem discussed in Section 5-3 of this chapter. wants to replace his equipment at least every 2 years. year old and 10% for any equipment that is 2 years old. remaining leasing costs over the next 5 years and when he should replace his equipment under the selected contract. effect does this have on the formulation and solution of the problem? Which of the two leasing contracts is optimal in this case? (Round your answers to the nearest dollar.) The cost in dollars on each arc increases by $ . The optimal plan under both leasing options is to replace the equipment at the beginning of years . However, leasing provides the lowest total cost in dollars of $ +$62,000 and is therefore the preferred alternative. Consider the following equipment replacement problem discussed in Section 5-3 of this chapter. wants to replace his equipment at least every 2 years. year old and 10% for any equipment that is 2 years old. remaining leasing costs over the next 5 years and when he should replace his equipment under the selected contract. effect does this have on the formulation and solution of the problem? Which of the two leasing contracts is optimal in this case? (Round your answers to the nearest dollar.) The cost in dollars on each arc increases by $ . The optimal plan under both leasing options is to replace the equipment at the beginning of years . However, leasing provides the lowest total cost in dollars of $ +$62,000 and is therefore the preferred alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts