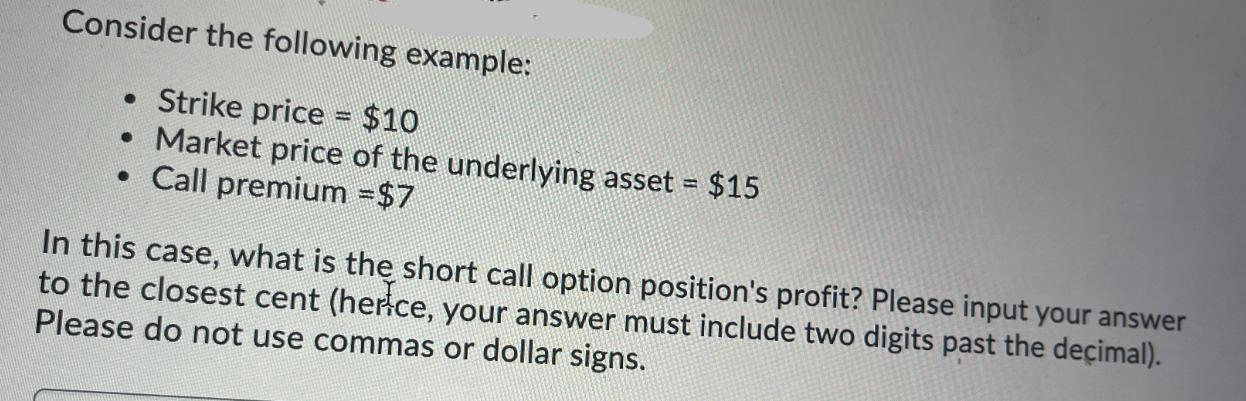

Question: Consider the following example: Strike price = $10 Market price of the underlying asset = $15 Call premium =$7 In this case, what is

Consider the following example: Strike price = $10 Market price of the underlying asset = $15 Call premium =$7 In this case, what is the short call option position's profit? Please input your answer to the closest cent (herce, your answer must include two digits past the decimal). Please do not use commas or dollar signs.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

The short call option positions profit is determined based on the difference between t... View full answer

Get step-by-step solutions from verified subject matter experts