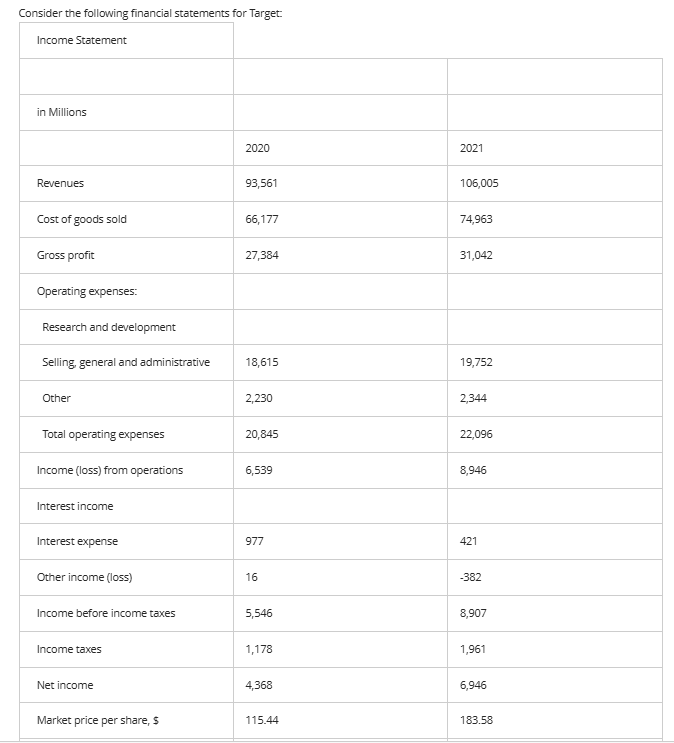

Question: Consider the following financial statements for Target: begin { tabular } { | l | l | l | } hline Income Statement

Consider the following financial statements for Target: begintabularlllhline Income Statement & multicolumnchline in Millions & & hline & & hline Revenues & & hline Cost of goods sold & & hline Gross profit & & hline Operating expenses: & & hline Research and development & & hline Selling, general and administrative & & hline Other & & hline Total operating expenses & & hline Income loss from operations & & hline Interest income & & hline Interest expense & & hline Other income loss & & hline Income before income taxes & & hline Income taxes & & hline Net income & & hline Market price per share, $ & & hline endtabularbegintabularlll

hline Number of shares million & &

hline Balance Sheet & multicolumnc

hline in Millions & &

hline & &

hline Assets & &

hline Current assets: & &

hline Cash and cash equivalents & &

hline Accounts receivable & &

hline Inventory & &

hline Other current assets & &

hline Total current assets & &

hline Property, plant and equipment, net & &

hline Other noncurrent assets & &

hline Total assets & &

hline Liabilities & &

hline Current liabilities: & &

hline Accounts payable & &

hline Other current liabilities & &

hline

endtabularbegintabularlll

hline Total current liabilities & &

hline Longterm debt & &

hline Other longterm liabilities & &

hline Total liabilities & &

hline Stockholders' equity & &

hline Other items & &

hline Total liabilities and equity & &

hline

endtabular

Calculate the following ratios for fiscal year and match them to given answers. current ratio

quick ratio

total debt ratio

debttoequity ratio

days sales in receivables

days sales in inventory

net profit margin

return on equity

pricetoearnings ratio

markettobook ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock