Question: Consider the following for Suarez Computer Center during July and August 201X, the first two months of operations: (Click the icon to view the July

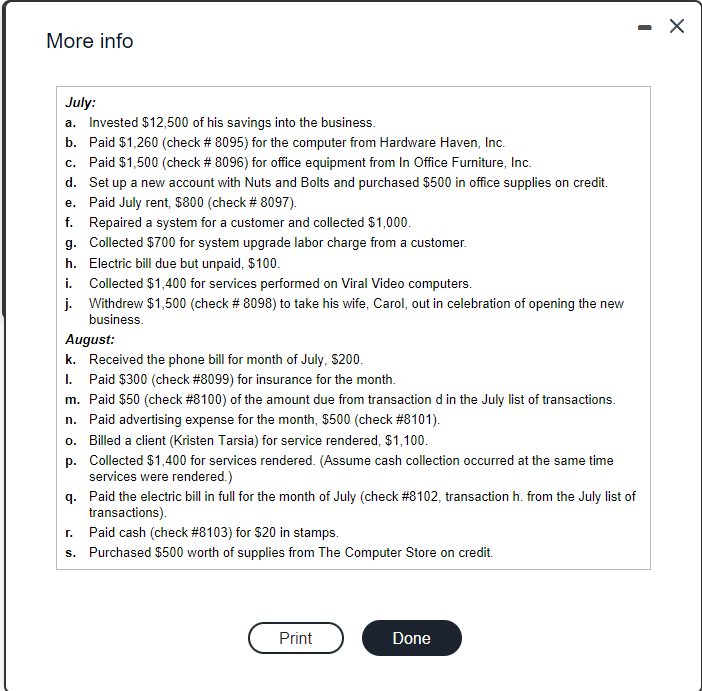

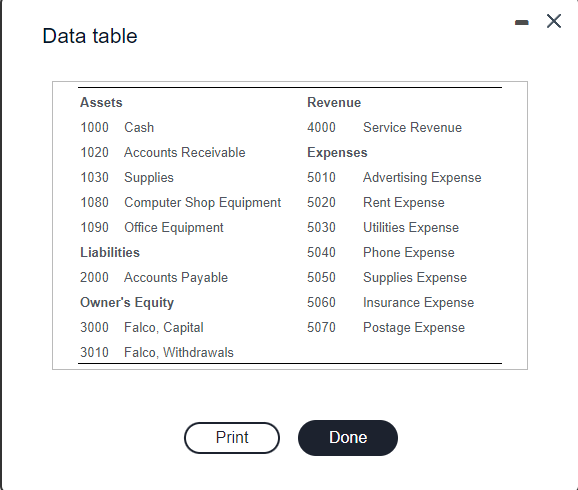

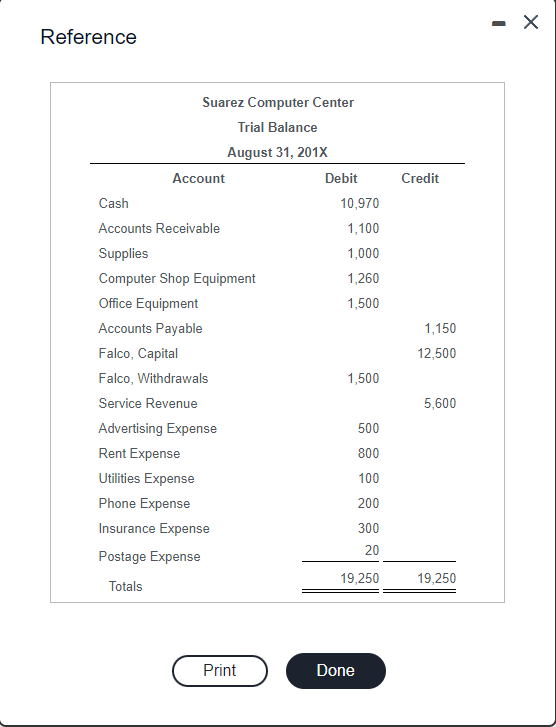

Consider the following for Suarez Computer Center during July and August 201X, the first two months of operations: (Click the icon to view the July and August transactions.) (Click the icon to view the chart of accounts.) (Click the icon to view the August trial balance.) .. Assignment 1. Record the September transactions in the general journal. Prepare the entries in the same order as given in the problem beginning with the transaction on September 1. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. For purposes of General Journal Page 1 Date Account Titles and Description PR Dr. Cr. Assignment 2018 Sep. 1. Record the September transactions. 2. Post all journal entries to the general ledger accounts (the Prepaid Rent Account #1025 has been added to the chart of accounts). 3. Prepare a trial balance for September 30, 201X. 4. Prepare the financial statements for the 3 months ended September 30, 201X. Print Done More info July: a. Invested $12,500 of his savings into the business. b. Paid $1,260 (check # 8095) for the computer from Hardware Haven, Inc. c. Paid $1,500 (check # 8096) for office equipment from In Office Furniture, Inc. d. Set up a new account with Nuts and Bolts and purchased $500 in office supplies on credit. e. Paid July rent, $800 (check # 8097). f. Repaired a system for a customer and collected $1,000. g. Collected $700 for system upgrade labor charge from a customer. h. Electric bill due but unpaid $100. i. Collected $1,400 for services performed on Viral Video computers. j. Withdrew $1,500 (check # 8098) to take his wife, Carol, out in celebration of opening the new business. August: k. Received the phone bill for month of July, $200. 1. Paid $300 (check #8099) for insurance for the month. m. Paid $50 (check #8100) of the amount due from transaction d in the July list of transactions. n. Paid advertising expense for the month, $500 (check #8101). 0. Billed a client (Kristen Tarsia) for service rendered, $1,100. p. Collected $1,400 for services rendered. (Assume cash collection occurred at the same time services were rendered.) q. Paid the electric bill in full for the month of July (check #8102, transaction h. from the July list of transactions). 1. Paid cash (check #8103) for $20 in stamps. s. Purchased $500 worth of supplies from The Computer Store on credit. Print Done - x Data table Assets 1000 Cash 1020 Accounts Receivable 1030 Supplies 1080 Computer Shop Equipment 1090 Office Equipment Liabilities 2000 Accounts Payable Owner's Equity 3000 Falco, Capital 3010 Falco, Withdrawals Revenue 4000 Service Revenue Expenses 5010 Advertising Expense 5020 Rent Expense 5030 Utilities Expense 5040 Phone Expense 5050 Supplies Expense 5060 Insurance Expense 5070 Postage Expense Print Done - X Reference Credit Suarez Computer Center Trial Balance August 31, 2017 Account Debit Cash 10,970 Accounts Receivable 1,100 Supplies 1,000 Computer Shop Equipment 1,260 Office Equipment 1,500 Accounts Payable Falco, Capital Falco, Withdrawals 1,500 Service Revenue Advertising Expense 500 Rent Expense 800 Utilities Expense 100 Phone Expense 200 Insurance Expense 300 20 Postage Expense Totals 19,250 1,150 12,500 5,600 19,250 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts