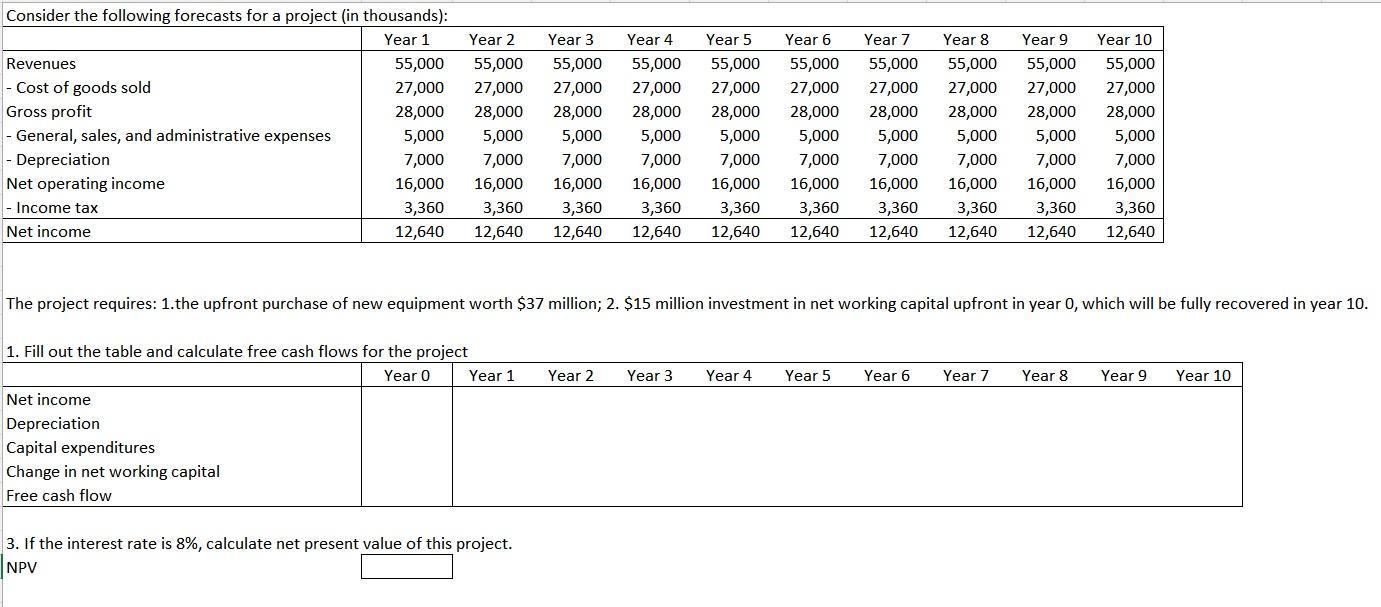

Question: Consider the following forecasts for a project (in thousands): Year 1 55,000 55,000 27,000 27,000 28,000 5,000 7,000 Revenues - Cost of goods sold

Consider the following forecasts for a project (in thousands): Year 1 55,000 55,000 27,000 27,000 28,000 5,000 7,000 Revenues - Cost of goods sold Gross profit - General, sales, and administrative expenses - Depreciation Net operating income - Income tax Net income 16,000 3,360 12,640 Net income Depreciation 1. Fill out the table and calculate free cash flows for the project Year 0 Capital expenditures Change in net working capital Free cash flow Year 2 Year 3 Year 4 Year 5 Year 6 55,000 55,000 55,000 55,000 55,000 55,000 55,000 27,000 27,000 27,000 27,000 27,000 28,000 28,000 5,000 27,000 27,000 28,000 28,000 28,000 28,000 28,000 28,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 7,000 7,000 7,000 7,000 7,000 7,000 7,000 7,000 7,000 16,000 16,000 16,000 16,000 16,000 16,000 16,000 16,000 16,000 3,360 3,360 3,360 3,360 3,360 3,360 3,360 12,640 12,640 12,640 12,640 12,640 12,640 12,640 12,640 3,360 3,360 12,640 The project requires: 1.the upfront purchase of new equipment worth $37 million; 2. $15 million investment in net working capital upfront in year 0, which will be fully recovered in year 10. Year 1 3. If the interest rate is 8%, calculate net present value of this project. NPV Year 2 Year 3 Year 7 Year 4 Year 5 Year 8 Year 9 Year 6 Year 7 Year 10 55,000 27,000 28,000 Year 8 Year 9 Year 10

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Ill help you fill out the table and then calculate the free cash flows for the project according to the information provided in the image Free Cash Fl... View full answer

Get step-by-step solutions from verified subject matter experts