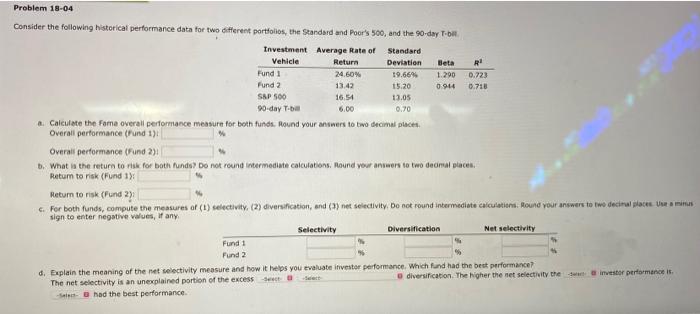

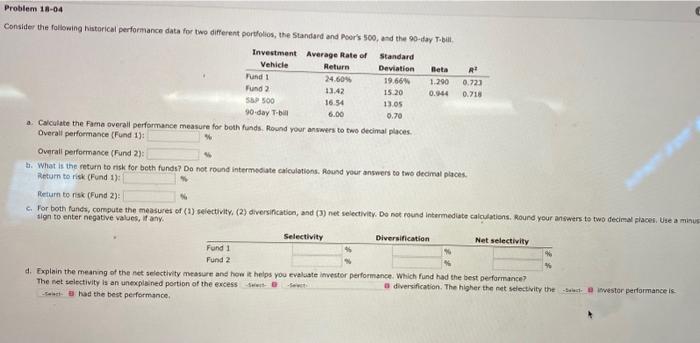

Question: Consider the following histerical performance data for two different partfolios, the Standsrd and Poor's 500 , and the 90-day T.bil a. Caleulete the fome overall

Consider the following histerical performance data for two different partfolios, the Standsrd and Poor's 500 , and the 90-day T.bil a. Caleulete the fome overall performance measure for both funds. Mound your ansiners to tavo decimal places. Overali performance (f und 1) Overail peeformance (fand 2)! b. What is the return to rigk for bath funds? Do not round intermediate calculabons. Pound yout anseers to two deomal elaces. Retum to risk (Fund 1): Metum to risk (Fund 2): sign, to enter negative values, if any 6. Explain the meaning of the ret selectivity measure and how it helps you evaluate itivester performance, Which fand had the beck periormance? b diversificaton. The higher the aet selectivity the imvestor performanice is. The net selectivity is an unerplained portion of the excess -seset at aei had the best performance. Consider the following historical performance data for two different portolios, the 5tandard and Poor's 500 , and the 90 -ifay Tobili. a. Caiculate the Fama overail perfarmance measure for both funds. Rosnd your answers to two decimal places. Dverall performance (Fund 1): Overail performance (Fund 2): Which b. What is the retutn to risk for beth funds? Do not round intermesate caiculations. Rousd your answers to two decimal places. Return to risk (Fund 1): foeturn to risk (Fund 2): sign to enter negative values, if aty. d. Explain the meaning of the Ret selectivity measure ans new it helps you evalute itivester performance. Which fund had the best perfarmance? The ret selectivity is an unexplsined portion of the excess a diversification. The higher the net selectity the had the best performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts