Question: Consider the following information about four different projects. Each requires an initial outlay of Rs ( 1 , 0 0 0 , 0 0

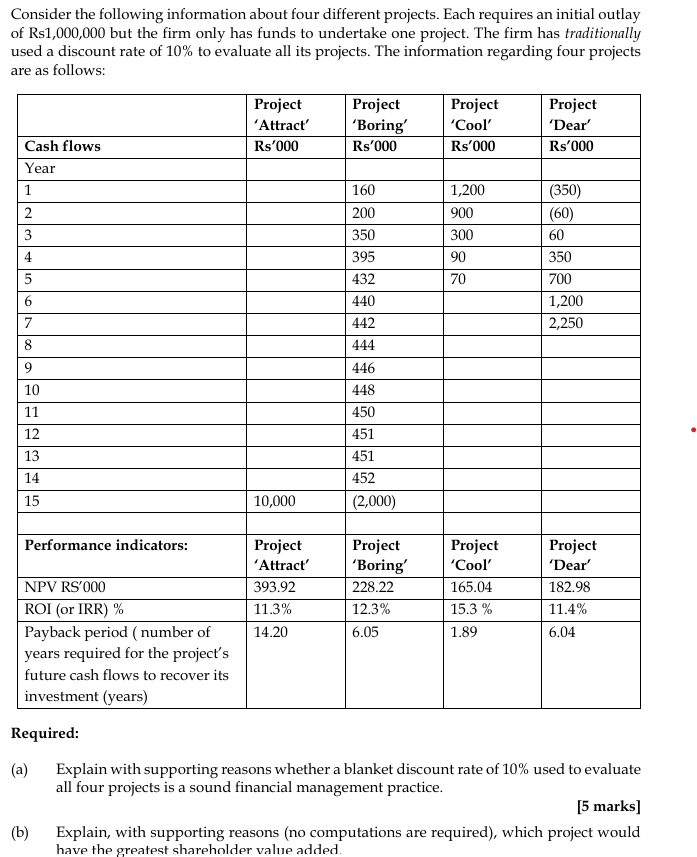

Consider the following information about four different projects. Each requires an initial outlay of Rs but the firm only has funds to undertake one project. The firm has traditionally used a discount rate of to evaluate all its projects. The information regarding four projects are as follows:

begintabularccccc

hline & begintabularl

Project

'Attract'

endtabular & begintabularl

Project

'Boring'

endtabular & begintabularl

Project

'Cool'

endtabular & Project 'Dear'

hline Cash flows & Rs & Rs & Rs & Rs

hline multicolumnlYear

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline & & & &

hline Performance indicators: & begintabularl

Project

'Attract'

endtabular & Project 'Boring' & Project 'Cool' & Project 'Dear'

hline NPV RS & & & &

hline ROI or IRR & & & &

hline Payback period number of years required for the project's future cash flows to recover its investment years & & & &

hline

endtabular

Required:

a Explain with supporting reasons whether a blanket discount rate of used to evaluate all four projects is a sound financial management practice.

marks

b Explain, with supporting reasons no computations are required which project would have the greatest shareholder value added.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock