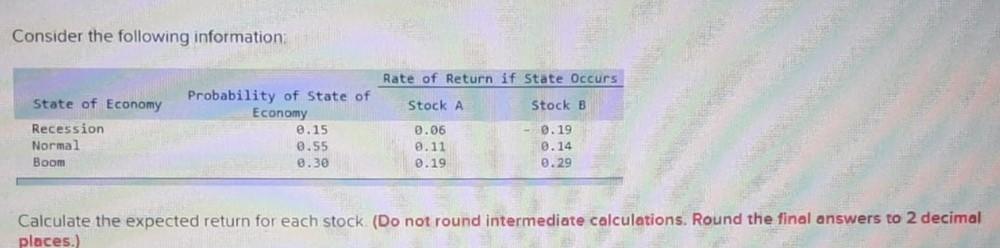

Question: Consider the following information: Calculate the expected return for each stock. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Suppose

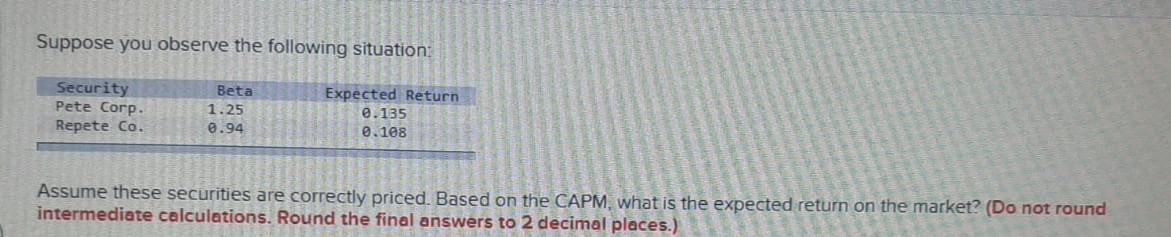

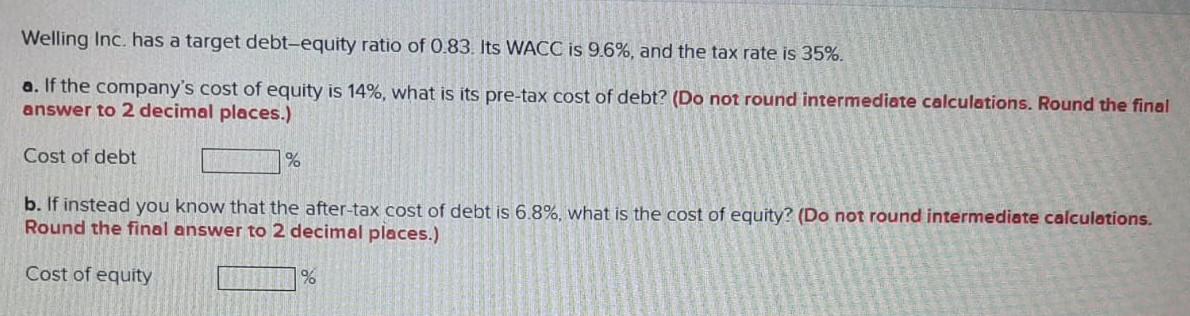

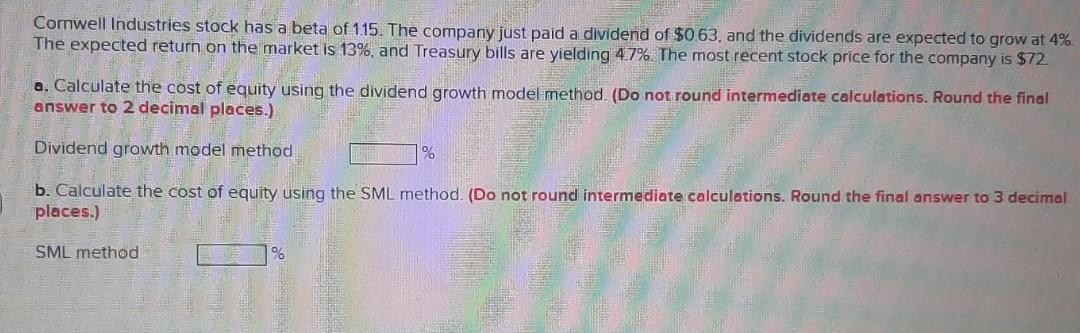

Consider the following information: Calculate the expected return for each stock. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Welling Inc. has a target debt-equity ratio of 0.83 . Its WACC is 9.6%, and the tax rate is 35%. a. If the company's cost of equity is 14%, what is its pre-tax cost of debt? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of debt b. If instead you know that the after-tax cost of debt is 6.8%, what is the cost of equity? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of equity % Cornwell Industries stock has a beta of 115 . The company just paid a dividend of $0.63, and the dividends are expected to grow at 4%. The expected return on the market is 13%, and Treasury bills are yielding 4.7%. The most recent stock price for the company is $72 a. Calculate the cost of equity using the dividend growth model method. (Do not round intermediote calculotions. Round the final answer to 2 decimal places.) Dividend growth model method b. Calculate the cost of equity using the SML method. (Do not round intermediate calculations. Round the final answer to 3 decimal places.) SML method Consider the following information: Calculate the expected return for each stock. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Welling Inc. has a target debt-equity ratio of 0.83 . Its WACC is 9.6%, and the tax rate is 35%. a. If the company's cost of equity is 14%, what is its pre-tax cost of debt? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of debt b. If instead you know that the after-tax cost of debt is 6.8%, what is the cost of equity? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of equity % Cornwell Industries stock has a beta of 115 . The company just paid a dividend of $0.63, and the dividends are expected to grow at 4%. The expected return on the market is 13%, and Treasury bills are yielding 4.7%. The most recent stock price for the company is $72 a. Calculate the cost of equity using the dividend growth model method. (Do not round intermediote calculotions. Round the final answer to 2 decimal places.) Dividend growth model method b. Calculate the cost of equity using the SML method. (Do not round intermediate calculations. Round the final answer to 3 decimal places.) SML method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts