Question: Consider the following information given below: table [ [ ( $ in millions,excep,as , noted,,,,Yea,r , Year,r , 1 , , Year 2 ,

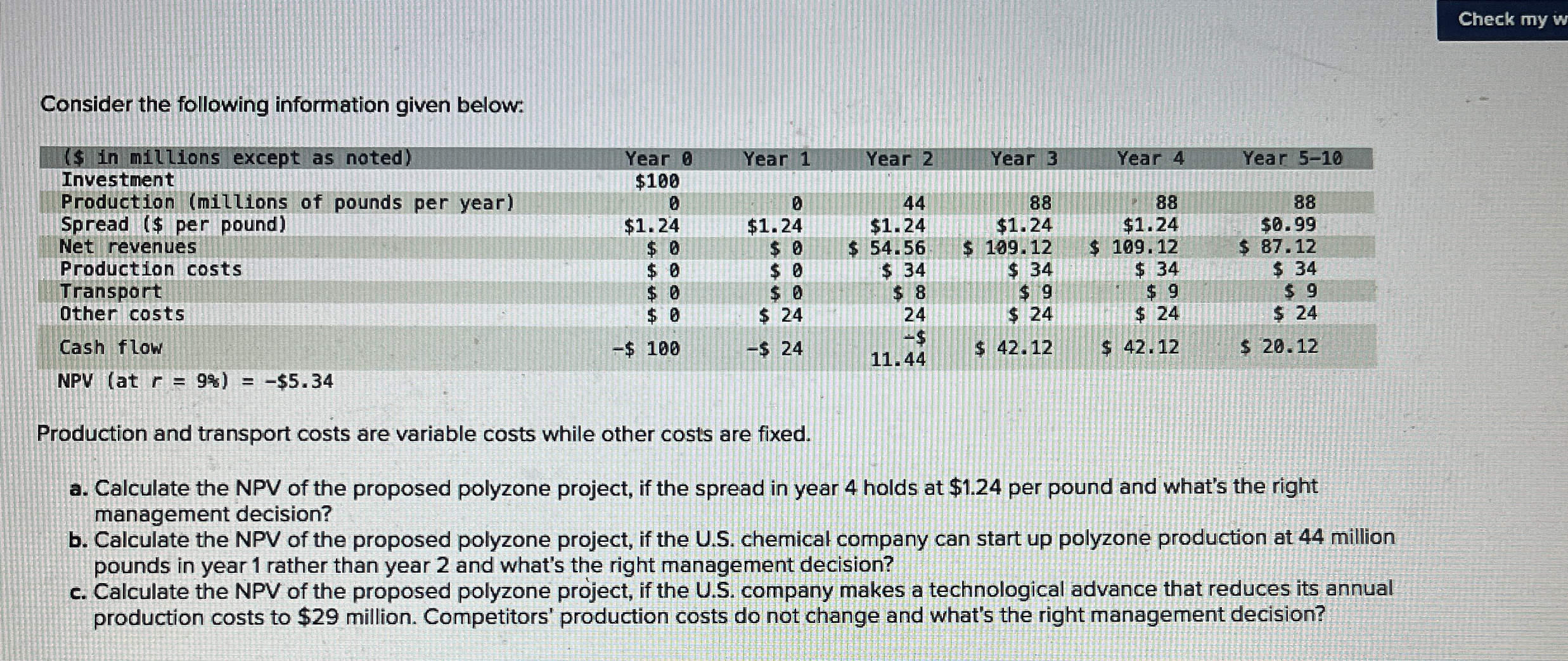

Consider the following information given below:

table $ in millions,excep,asnoted,,,,Yea,rYear,rYear Year Year Year Investment$Production millions,ofpounds,per,yearSpread $ per ppound$$$$$$Net revenues,,,,,,,$$$$$Production cost$$$ $ $ $ Transport$$$$ $Other costs,,,,,,,$$$ $ $ Cash flow,,,,,,,$ $$ $$

NPV at $

Production and transport costs are variable costs while other costs are fixed.

a Calculate the NPV of the proposed polyzone project, if the spread in year holds at $ per pound and what's the right management decision?

b Calculate the NPV of the proposed polyzone project, if the US chemical company can start up polyzone production at million pounds in year rather than year and what's the right management decision?

c Calculate the NPV of the proposed polyzone project, if the US company makes a technological advance that reduces its annual production costs to $ million. Competitors' production costs do not change and what's the right management decision?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock