Question: Consider the following information given below: table [ [ [ 5 if millishs excrpt as neted ] , Tear,Year 1 , Year 2 ,

Consider the following information given below:

table if millishs excrpt as netedTear,Year Year Year Year Year InvestmentProductisn millisons of pounds per yearSpread s per pound$$Met revenues, $ett eteProductiso costs,TransportOther casts,Cash flow,NPV at r m

Production and transport costs are variable costs while other costs are fived.

A Calculate the NPV of the proposed polyzone project, if the speead in year holds at $ per pound and wharss the right management decision?

b Calculate the NPV of the proposed polyrone project, if the US chemical compary can stiml up polyrone production at milion pounds in year I rather than year and what's the right management decision?

C Calculate the NPV of the proposed polyrone project, if the US compary makes a technological advance that reduces iss annual production costs to $ milion. Compettors' production costs do not change and what's the right management decision?

Cemplete this question by entering your answers in the tabs below.

Required a

Caloulate the NPV of the proporied polytone project, if the sproas in rear holds at per pound and whats phe nght management decision?

Notei Do fot round intermediate calculationt. A negative answer ahould be indicated by a minus sign. Enoer your ahomer in millignt rounded to decirnal places.

thene lesest

tableNefl peetiert valut,Right mavapement decinion,milionsPhotogrophic labormoories recover and necycle the silver used in pholographic film. Srikine River Photo is considering purchase of improved equipment for their laboratory at Telegraph Creek. Here is the informetion they have:

The equipment costs $ and will cost $ per year to run.

It has an economic lfe of years but can be depredated over five years by the straightline method.

It wif recover an additional ounces of silver per year.

Silver is selling for $ per ounce. Over the past years, the price of silver has appreciated by per year in real terms. Silver is traded in an active, competitive market.

Sokine's manginal tax rate is

Sokine's company cost of capital is in real ferms.

The nominal interest rate is k

What is the NPV of the new equipment? Assume Tex Cuts and Jobs Act, where wribeoff of imestment expendifures, is not applicable.

Noter Do mot round intermediate calculations. Round your answer to nearest whole doller amount.

Wet presert valueA project has foed costs of $ per yeac, depreciation charges of $ a yeac, annual revenue of $ variable costs equal to twothirds of revenues and the tax rate is K

a If sales increase by what will be the increase in pretax profis?

b What is the degree of operating leverage of this project? Note: Round your answer to decimal place.

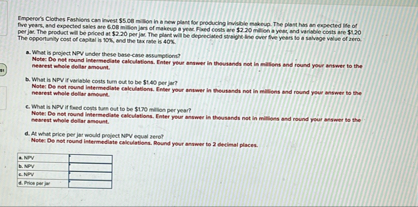

tablea Increase in pretax profts,,tabletinesTimperors Clothes Fashions can invest $ milion in a new plant for producing insiable exbeup. The plant hasi an expected life of per ja The product wli be pilced at $ per ja The plant will be deppeciated straighe lise over flue yesers lo a salvage valive of zera. The oppontinity cont of captal is and the tax rase is k

a What is project NPV under these basecine assurfption?

Nobe: De net round intepimediate caloulations. Titer your andeer in thovididh not in malions and round your antwer to the nearest mhole dollsr mount.

b What in NPV if variable coits tum but to be tab per jar?

Noter Des not nound istermediate calculationa. Fibter your antwer in theusands not in millions and round your avswer to the nesrent whole dellar ampont.

What in NPV if fined copts hase out to be $ mallos per year?

Noter De not round limermediate calculations. Coter your answer is thousands not in milloses and round your aiswer bo the neborest wheple dollar amoust.

d At what price per jar mould project NPV equal aerof

Noter De not round intermediate calculationa. Round your anvewer to decimal placen.

tablea NPYb NPVcnpy Prioeperjer,

A candidste drug requires an $ milion investment for phaselil clinical trials. If the blids are successlu probabilyh the company will leam the drug's scope of use and update its forecast of the drug's PV at commercial leunch.

The investment required for the phase II trials and prelaunch outlays is $ million. The probabiliy of success in phase ilis and prelaunch is Bok. Launch comes thise years after the start of phase it if the dug is noproved by the FDA. The probabilities of the lesm the commercial potential of the drug. which will depend on how widely it can be used.

Suppose that the forecasted PV at launch depends on the scope of une allowed by the FDA. These are an upside outcome of NoVV $ milion if the drug can be widely used, a most likely case with NPV $ million, and a downside case of NPV $ milion if the drug's scope is greatly resticted. We assume a riskfree rate of K and market risk poemilum of Th Assume FDA approved phamaceufleal products have asvet betas of and the opporlunity coat of caplial is Accordingly. The NpV works out to $ million.

The RAD team has pat foreard a proposal to irvest an extra $ milion in expanded phase ll blabs. Phase If tabes tivo years. The object is to prove that the drug can be administered by a simple intaler swher than as a liquid. If successfla, the scope of ube is broadened and the upside PV increases to $ bilion. The probublilites of success are unchanged. Une Bgure

HCalculate the NPV

Notec Do not round imtermediate calculationa. Enter your anower in militons rounded to decimal pleces.

a Is the extras $ milison investment worthwhile?

bLAstuming that the probabily of sucoess in the phase lil trials falls K recalculabe the NPV with the ertrs millon investment. Nobe: Do not round intermediate calculations. Finter your answer in milligns rounded to decimal places.

b Is the extra milion investment worthwhlle?

Cemplete thle question by enterligg your anawers in the tabs below.

Rea

Caloulate the NPV

Note: De not round intermediabt calculabions. Inter vour answer in mbions rounded to decimal glaces.

NeV

milionM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock