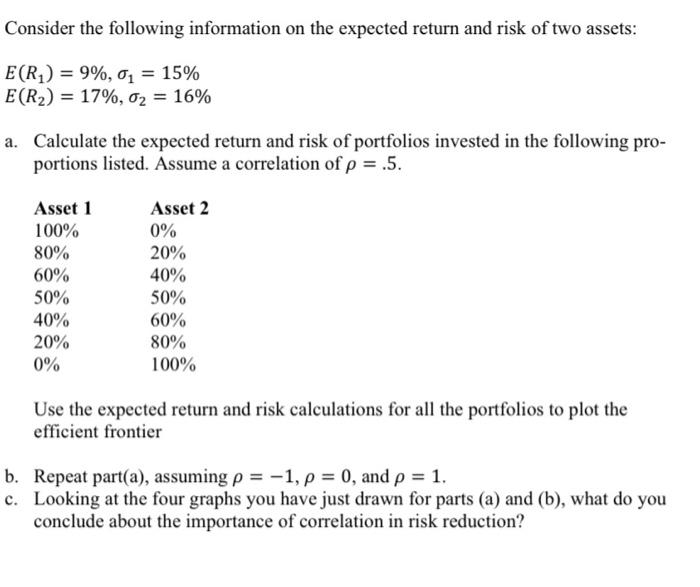

Question: Consider the following information on the expected return and risk of two assets: E(R) = 9%, 01 = 15% E(R2) = 17%, 02 = 16%

Consider the following information on the expected return and risk of two assets: E(R) = 9%, 01 = 15% E(R2) = 17%, 02 = 16% a. Calculate the expected return and risk of portfolios invested in the following pro- portions listed. Assume a correlation of p = .5. Asset 1 100% 80% 60% 50% 40% 20% 0% Asset 2 0% 20% 40% 50% 60% 80% 100% Use the expected return and risk calculations for all the portfolios to plot the efficient frontier b. Repeat part(a), assuming p = -1, p = 0, and p = 1. c. Looking at the four graphs you have just drawn for parts (a) and (b), what do you conclude about the importance of correlation in risk reduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts