Question: Consider the following information on three stocks Return Return Return Probability State of Stock C Stock B Stock A of State Economy 0.11 0.15 0.27

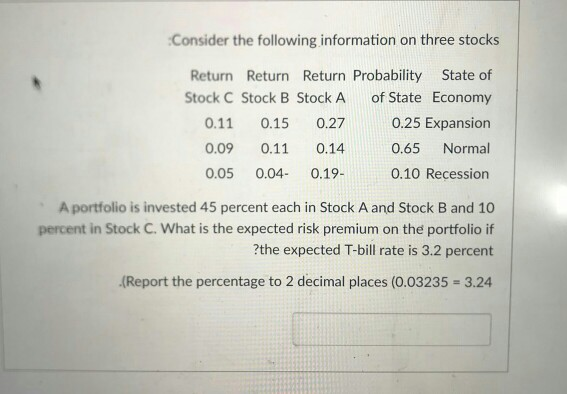

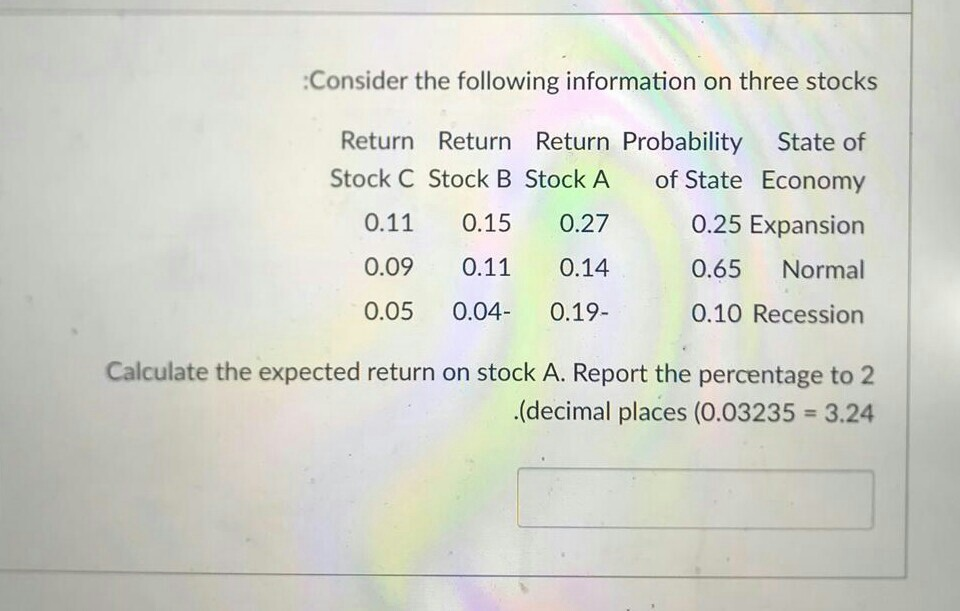

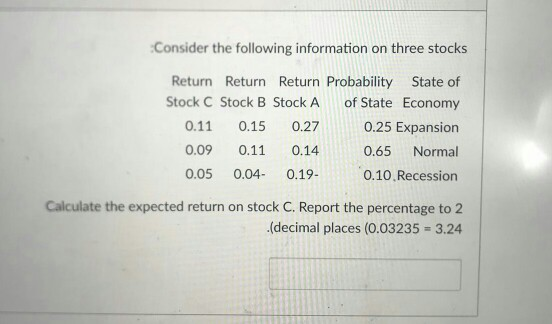

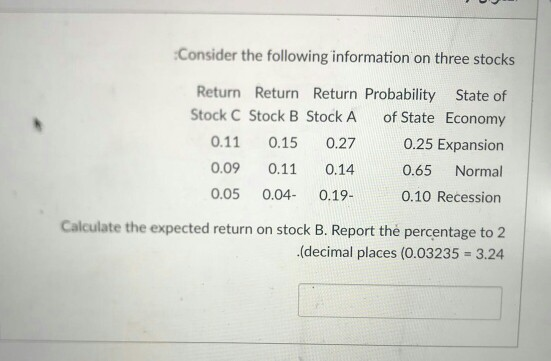

Consider the following information on three stocks Return Return Return Probability State of Stock C Stock B Stock A of State Economy 0.11 0.15 0.27 0.25 Expansion 0.65 Normal 0.10 Recession 0.09 0.11 0.14 0.05 0.04 0.19- A portfolio is invested 45 percent each in Stock A and Stock B and 10 percent in Stock C. What is the expected risk premium on the portfolio if ?the expected T-bill rate is 3.2 percent (Report the percentage to 2 decimal places (0.03235 3.24 Consider the following information on three stocks Return Return Return Probability State of Stock C Stock B Stock A of State Economy 0.11 0.15 0.27 0.25 Expansion 0.65 Normal 0.10 Recession 0.09 0.11 0.14 0.05 0.04 0.19 Calculate the expected return on stock A. Report the percentage to 2 .(decimal places (0.03235 3.24 Consider the following information on three stocks Return Return Return Probability State of Stock C Stock B Stock A of State Economy 0.25 Expansion 0.65 Normal 0.10,Recession 0.11 0.15 0.27 0.09 0.11 0.14 0.05 0.04 0.19 Calculate the expected return on stock C. Report the percentage to 2 .(decimal places (0.03235 3.24 Consider the following information on three stocks Return Return Return Probability State of Stock C Stock B Stock A of State Economy 0.11 0.15 0.27 0.25 Expansion 0.65 Normal 0.10 Recession Calculate the expected return on stock B. Report the percentage to 2 .(decimal places (0.03235 3.24 0.09 0.11 0.14 0.05 0.04 0.19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts