Question: Consider the following linear trend models estimated from 10 years of quarterly data with and without seasonal dummy variables d. d2. and d3. Here, d=1

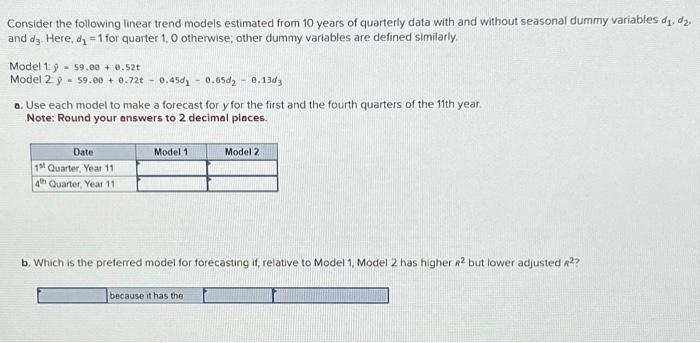

Consider the following linear trend models estimated from 10 years of quarterly data with and without seasonal dummy variables d1,d2. and d3. Here, d1=1 for quarter 1,0 otherwise; other dummy variables are defined similarly. Model 1,y^=59.00+0.52t Model 2y^=59.00+0.72t0.45d10.65d20.13d3 a. Use each model to make a forecast for y for the first and the fourth quarters of the 11th year. Note: Round your answers to 2 decimal places. b. Which is the preferred model for forecasting if, relative to Model 1, Model 2 has higher A2 but lower adjusted A2? Consider the following linear trend models estimated from 10 years of quarterly data with and without seasonal dummy variables d1,d2. and d3. Here, d1=1 for quarter 1,0 otherwise; other dummy variables are defined similarly. Model 1,y^=59.00+0.52t Model 2y^=59.00+0.72t0.45d10.65d20.13d3 a. Use each model to make a forecast for y for the first and the fourth quarters of the 11th year. Note: Round your answers to 2 decimal places. b. Which is the preferred model for forecasting if, relative to Model 1, Model 2 has higher A2 but lower adjusted A2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts