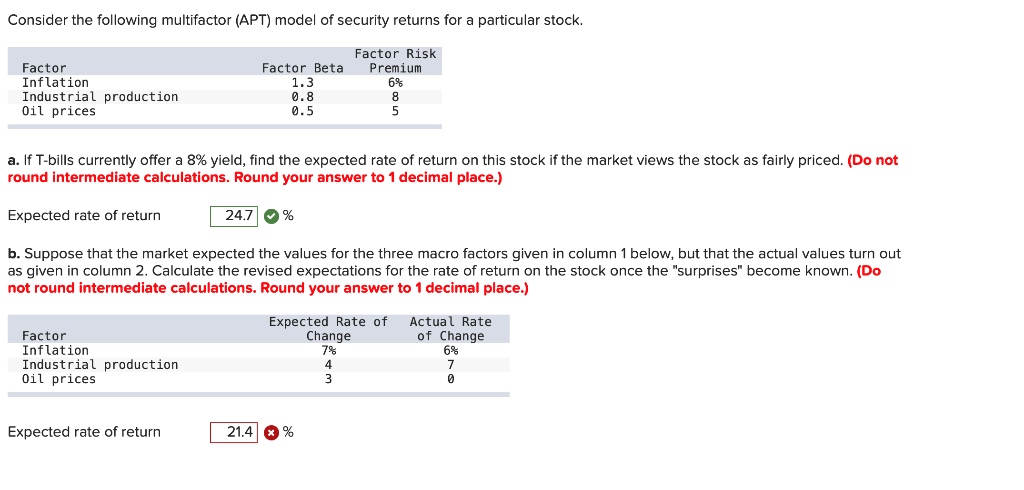

Question: Consider the following multifactor (APT) model of security returns for a particular stock. Factor Risk Premium 6% 8 5 Factor Inflation Industrial production Oil prices

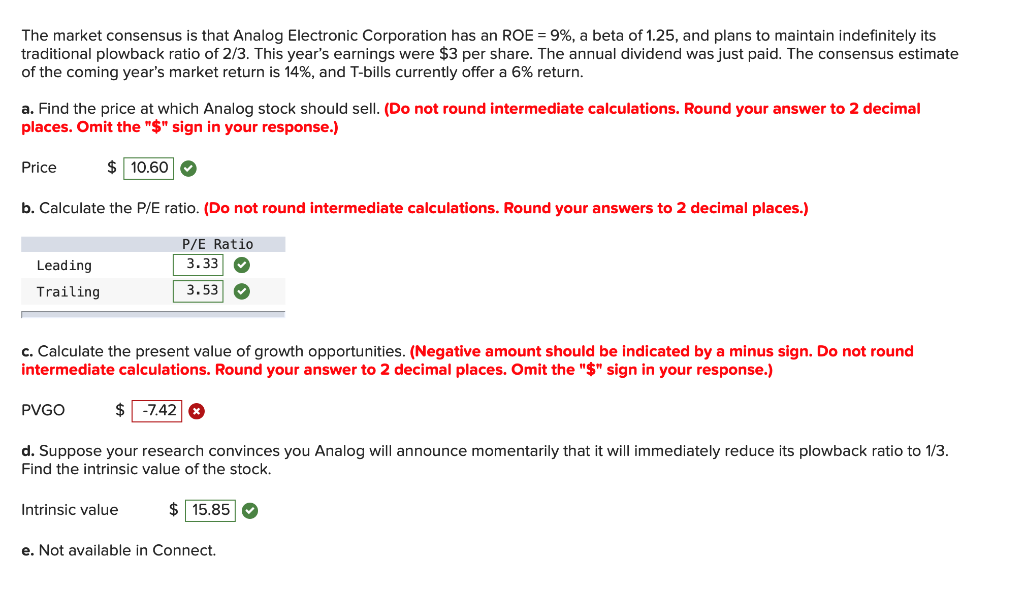

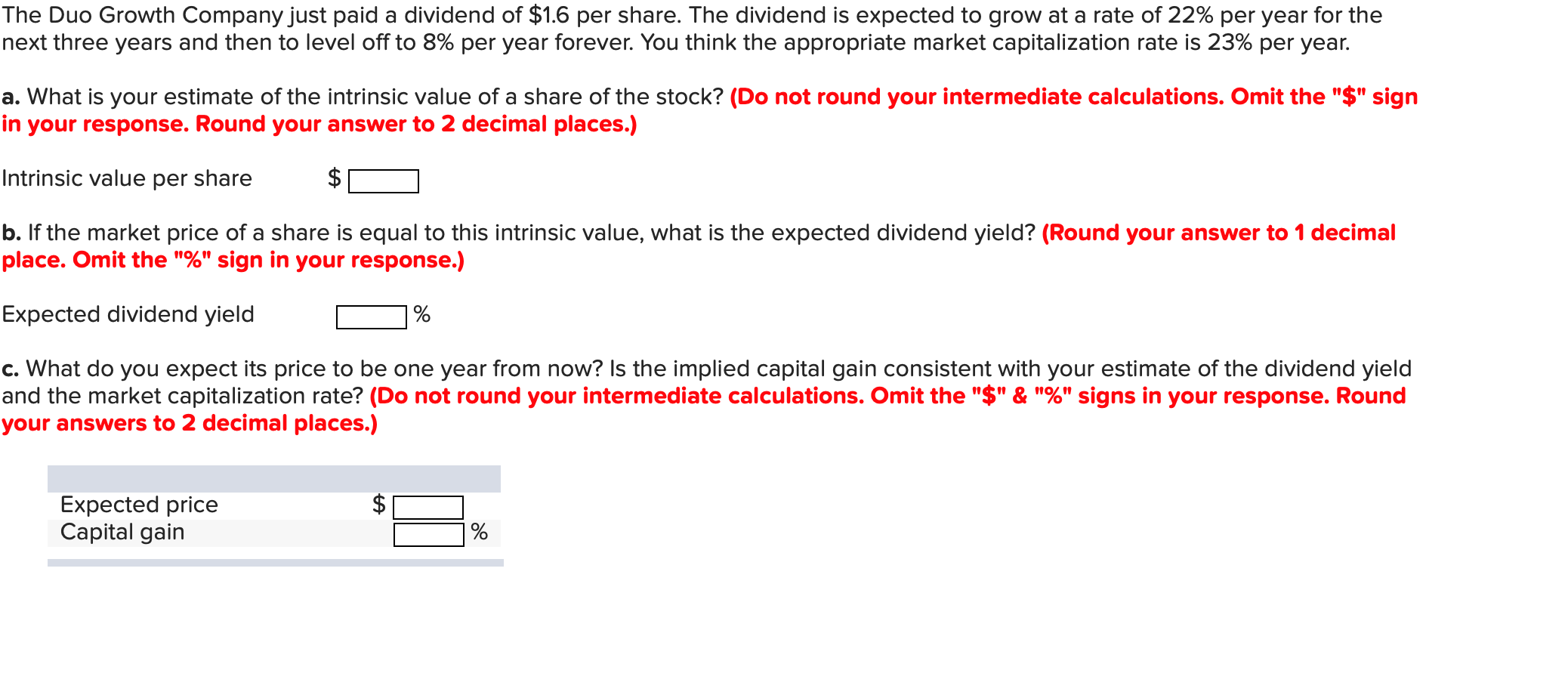

Consider the following multifactor (APT) model of security returns for a particular stock. Factor Risk Premium 6% 8 5 Factor Inflation Industrial production Oil prices a. If T-bills currently offer a 8% yield, find the expected rate of return on this stock if the market views the stock as fairly priced. (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected rate of return Factor Beta 1.3 0.8 0.5 Factor Inflation Industrial production Oil prices b. Suppose that the market expected the values for the three macro factors given in column 1 below, but that the actual values turn out as given in column 2. Calculate the revised expectations for the rate of return on the stock once the "surprises" become known. (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected rate of return 24.7% Expected Rate of Change 7% 4 3 21.4 % Actual Rate of Change 6% 7 0 The market consensus is that Analog Electronic Corporation has an ROE = 9%, a beta of 1.25, and plans to maintain indefinitely its traditional plowback ratio of 2/3. This year's earnings were $3 per share. The annual dividend was just paid. The consensus estimate of the coming year's market return is 14%, and T-bills currently offer a 6% return. a. Find the price at which Analog stock should sell. (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $10.60 Price b. Calculate the P/E ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places.) P/E Ratio 3.33 3.53 Leading Trailing c. Calculate the present value of growth opportunities. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) PVGO $ -7.42 x d. Suppose your research convinces you Analog will announce momentarily that it will immediately reduce its plowback ratio to 1/3. Find the intrinsic value of the stock. Intrinsic value $15.85 e. Not available in Connect. The Duo Growth Company just paid a dividend of $1.6 per share. The dividend is expected to grow at a rate of 22% per year for the next three years and then to level off to 8% per year forever. You think the appropriate market capitalization rate is 23% per year. a. What is your estimate of the intrinsic value of a share of the stock? (Do not round your intermediate calculations. Omit the "$" sign in your response. Round your answer to 2 decimal places.) Intrinsic value per share b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield? (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Expected dividend yield c. What do you expect its price to be one year from now? Is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate? (Do not round your intermediate calculations. Omit the "$" & "%" signs in your response. Round your answers to 2 decimal places.) Expected price Capital gain % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts