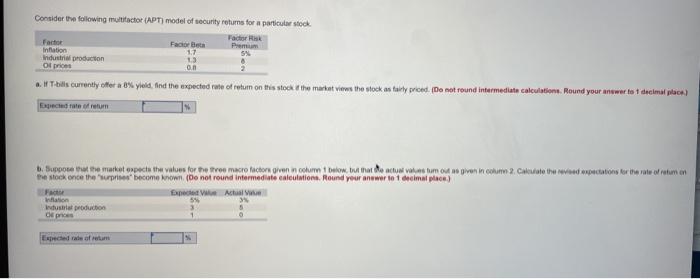

Question: Consider the following multifactor (APT) model of security returns for a particular stock Factor Factor Beta Premium Inflation 17 Industrial production 13 Otpris On a

Consider the following multifactor (APT) model of security returns for a particular stock Factor Factor Beta Premium Inflation 17 Industrial production 13 Otpris On a bills currently offer a 0% yield. Ind the expected rate of return on this stock the market view the stock as fairly prod. Do not round intermediate calculation. Round your answer to decimal place) Expected at return b. Suppose to the market expect the values for the three macro fiction given in our below. But that do actualus tum given in column 2 Cate the respectations for the role ofretum the stock once there become known (Do not round intermediate calculation. Round your answer to 1 decimal place) Actul. Istri production de pro 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts