Question: Consider the following one period trinomial model: = {1, 2, 3}, P(i) = 1/3 for i = 1, 2, 3, a bank account B with

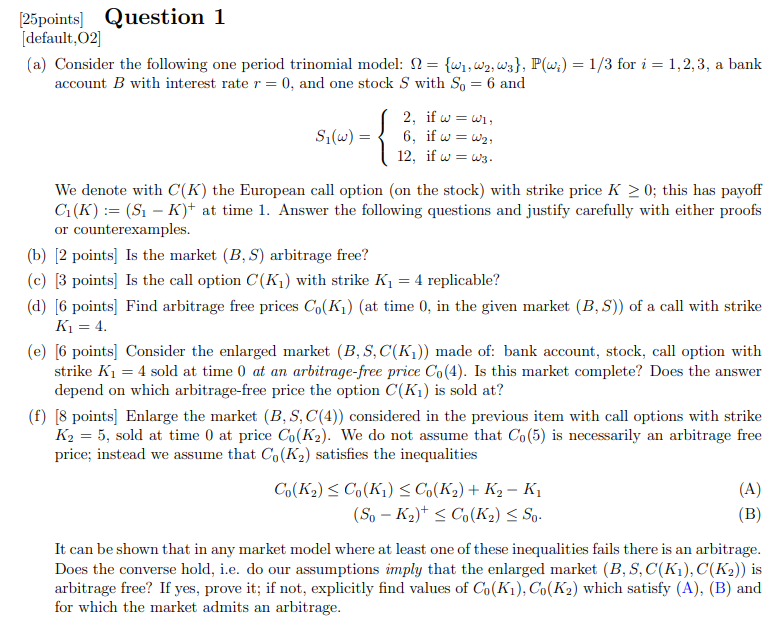

Consider the following one period trinomial model: = {1, 2, 3}, P(i) = 1/3 for i = 1, 2, 3, a bank account B with interest rate r = 0, and one stock S with S0 = 6 and S1() = 2, if = 1, 6, if = 2, 12, if = 3. We denote with C(K) the European call option (on the stock) with strike price K 0; this has payoff C1(K) := (S1 K) + at time 1. Answer the following questions and justify carefully with either proofs or counterexamples. (b) [2 points] Is the market (B, S) arbitrage free? (c) [3 points] Is the call option C(K1) with strike K1 = 4 replicable? (d) [6 points] Find arbitrage free prices C0(K1) (at time 0, in the given market (B, S)) of a call with strike K1 = 4. (e) [6 points] Consider the enlarged market (B, S, C(K1)) made of: bank account, stock, call option with strike K1 = 4 sold at time 0 at an arbitrage-free price C0(4). Is this market complete? Does the answer depend on which arbitrage-free price the option C(K1) is sold at? (f) [8 points] Enlarge the market (B, S, C(4)) considered in the previous item with call options with strike K2 = 5, sold at time 0 at price C0(K2). We do not assume that C0(5) is necessarily an arbitrage free price; instead we assume that C0(K2) satisfies the inequalities C0(K2) C0(K1) C0(K2) + K2 K1 (A) (S0 K2) + C0(K2) S0. (B) It can be shown that in any market model where at least one of these inequalities fails there is an arbitrage. Does the converse hold, i.e. do our assumptions imply that the enlarged market (B, S, C(K1), C(K2)) is arbitrage free? If yes, prove it; if not, explicitly find values of C0(K1), C0(K2) which satisfy (A), (B) and for which the market admits an arbitrage.

[25points] Question 1 [default,02] (a) Consider the following one period trinomial model: 2 = {W1, W2, W3}, P(wi) = 1/3 for i = 1,2,3, a bank account B with interest rate r = 0, and one stock S with So = 6 and S(W) = 2, if w=wi, 6, if w=w2, 12, if w=w3. We denote with C(K) the European call option (on the stock) with strike price K > 0; this has payoff C(K) := (Si - K) at time 1. Answer the following questions and justify carefully with either proofs or counterexamples. (b) [2 points] Is the market (B, S) arbitrage free? (c) [3 points] Is the call option C(K) with strike K1 = 4 replicable? (d) [6 points) Find arbitrage free prices Co(K) (at time 0, in the given market (B, S)) of a call with strike K1 = 4. (e) [6 points] Consider the enlarged market (B, S,C(K)) made of: bank account, stock, call option with strike Ki = 4 sold at time 0 at an arbitrage-free price Co (4). Is this market complete? Does the answer depend on which arbitrage-free price the option C(K1) is sold at? (f) (8 points) Enlarge the market (B,S, C(4)) considered in the previous item with call options with strike K2 = 5, sold at time 0 at price Co(K2). We do not assume that C.(5) is necessarily an arbitrage free price; instead we assume that Co(K) satisfies the inequalities Co(K)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts