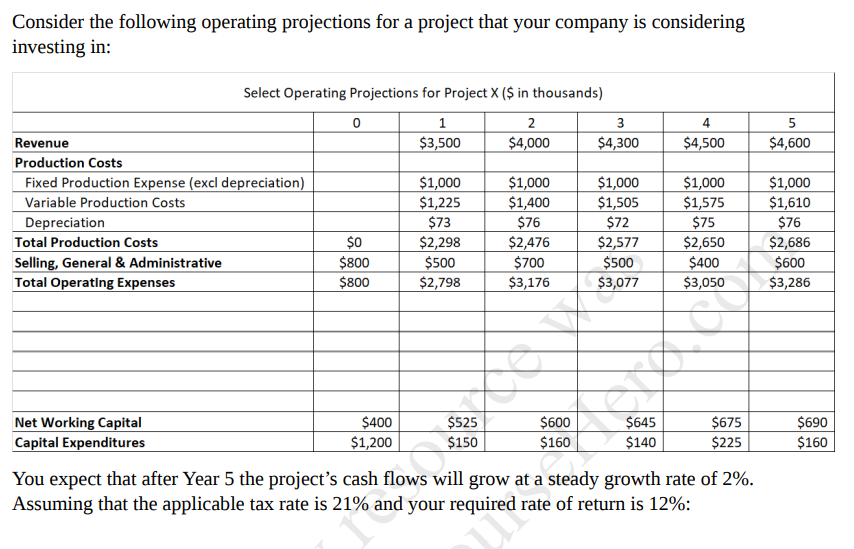

Question: Consider the following operating projections for a project that your company is considering investing in: 4 $4,500 5 $4,600 Select Operating Projections for Project X

Consider the following operating projections for a project that your company is considering investing in: 4 $4,500 5 $4,600 Select Operating Projections for Project X ($ in thousands) 0 1 2 3 Revenue $3,500 $4,000 $4,300 Production Costs Fixed Production Expense (excl depreciation) $1,000 $1,000 $1,000 Variable Production Costs $1,225 $1,400 $1,505 Depreciation $73 $76 $72 Total Production Costs $0 $2,298 $2,476 $2,577 Selling, General & Administrative $800 $500 $700 $500 Total Operating Expenses $800 $2,798 $3,176 $3,077 $1,000 $1,575 $75 $2,650 $400 $3,050 $1,000 $1,610 $76 $2,686 $600 $3,286 Net Working Capital Capital Expenditures $400 $1,200 $525 $150 $600 $160 $645 $140 $675 $225 $690 $160 You expect that after Year 5 the project's cash flows will grow at a steady growth rate of 2%. Assuming that the applicable tax rate is 21% and your required rate of return is 12%: Ow 3. What is the terminal value of the project? A. $8,061.73 B. $9,578.41 C. $10,762.08 D. $11,413.69 E. $12,249.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts