Question: Consider the following option strategy, called the call spread. It involves buying one call option with a lower strike price and selling one call

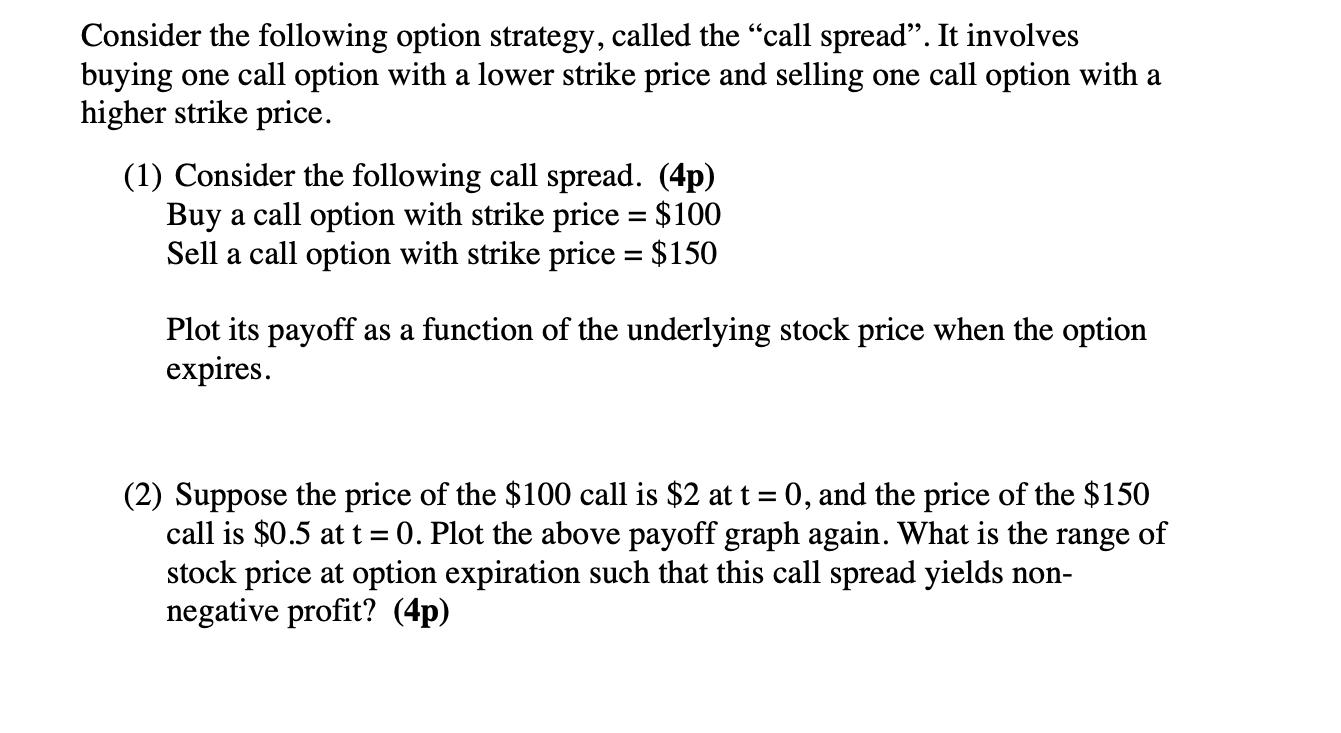

Consider the following option strategy, called the "call spread". It involves buying one call option with a lower strike price and selling one call option with a higher strike price. (1) Consider the following call spread. (4p) Buy a call option with strike price = $100 Sell a call option with strike price = $150 Plot its payoff as a function of the underlying stock price when the option expires. (2) Suppose the price of the $100 call is $2 at t = 0, and the price of the $150 call is $0.5 at t = 0. Plot the above payoff graph again. What is the range of stock price at option expiration such that this call spread yields non- negative profit? (4p)

Step by Step Solution

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts