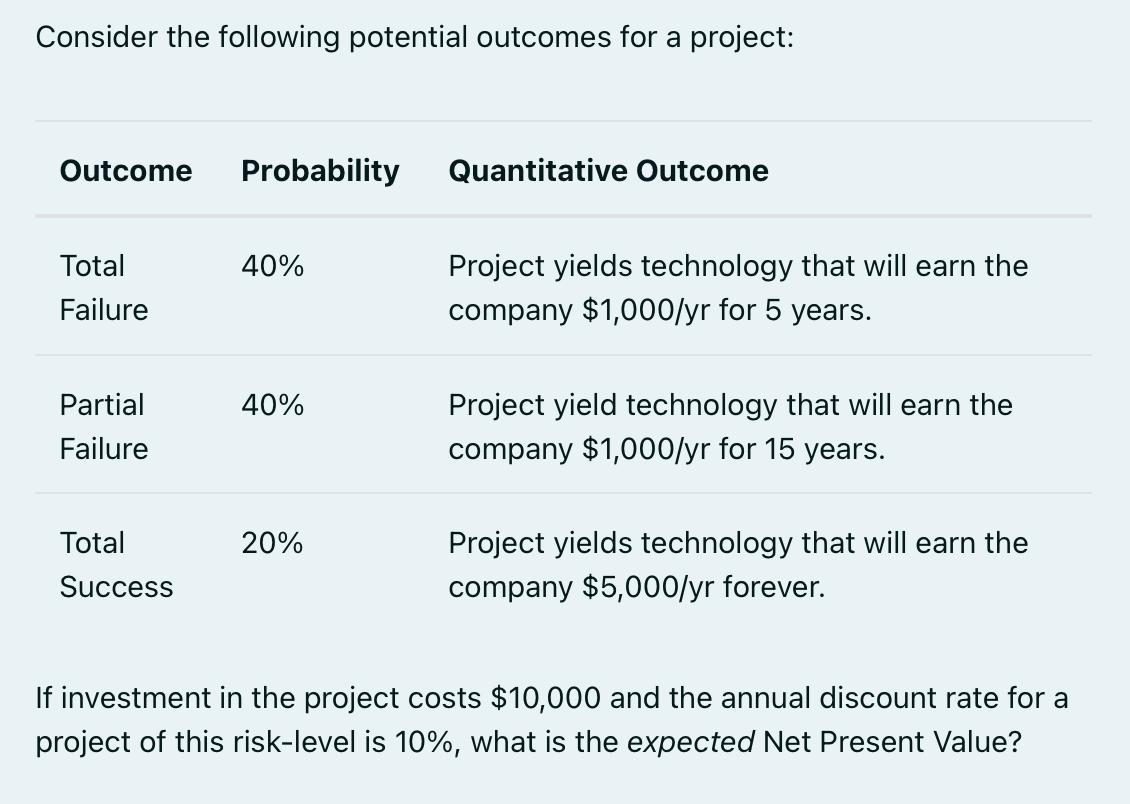

Question: Consider the following potential outcomes for a project: Outcome Probability Quantitative Outcome Total Failure Partial Failure Total Success 40% 40% 20% Project yields technology

Consider the following potential outcomes for a project: Outcome Probability Quantitative Outcome Total Failure Partial Failure Total Success 40% 40% 20% Project yields technology that will earn the company $1,000/yr for 5 years. Project yield technology that will earn the company $1,000/yr for 15 years. Project yields technology that will earn the company $5,000/yr forever. If investment in the project costs $10,000 and the annual discount rate for a project of this risk-level is 10%, what is the expected Net Present Value?

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the expected Net Present Value NPV of the project we need to calculate the pre... View full answer

Get step-by-step solutions from verified subject matter experts