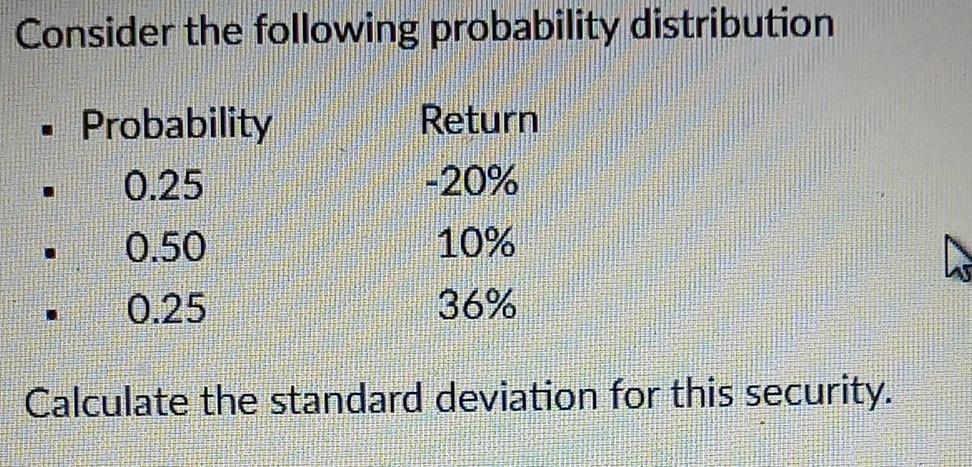

Question: Consider the following probability distribution Probability 0.25 Return -20% 0.50 10% ho 0.25 36% Calculate the standard deviation for this security. Choose the correct statement

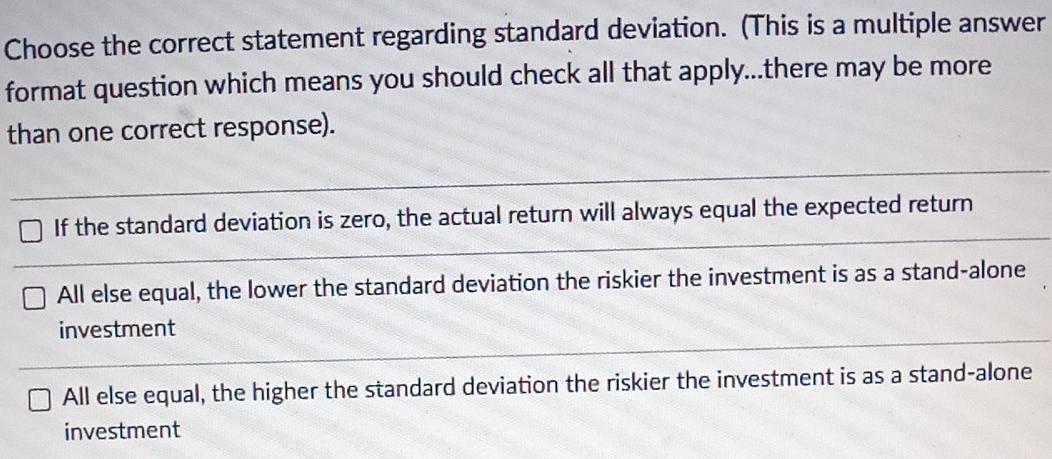

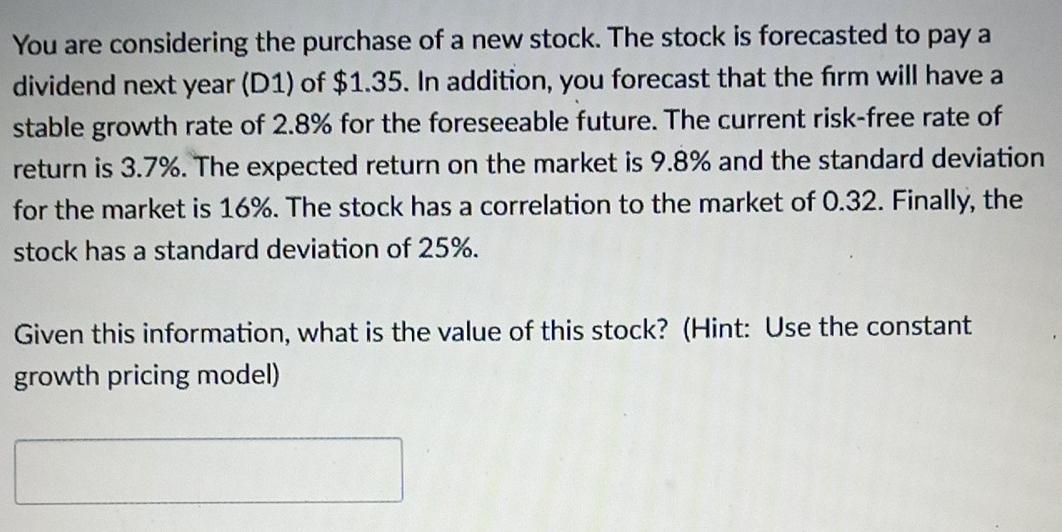

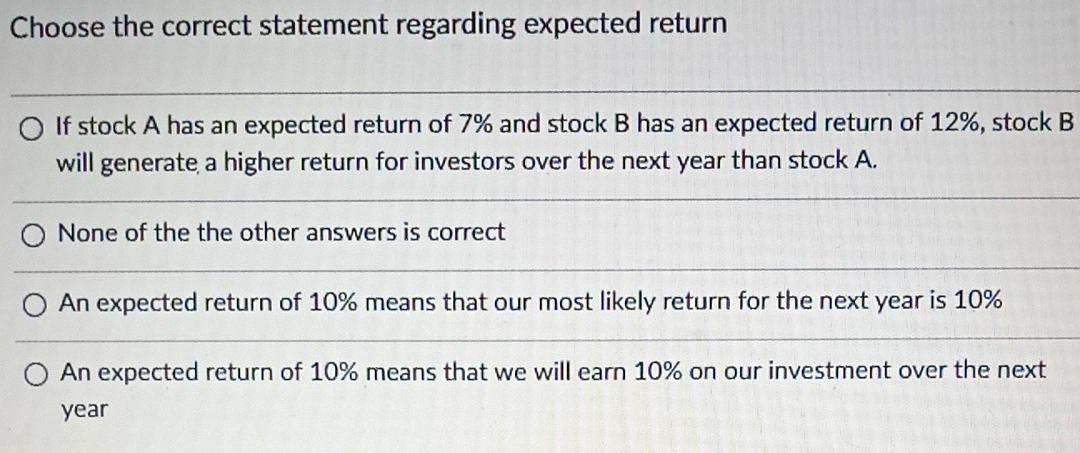

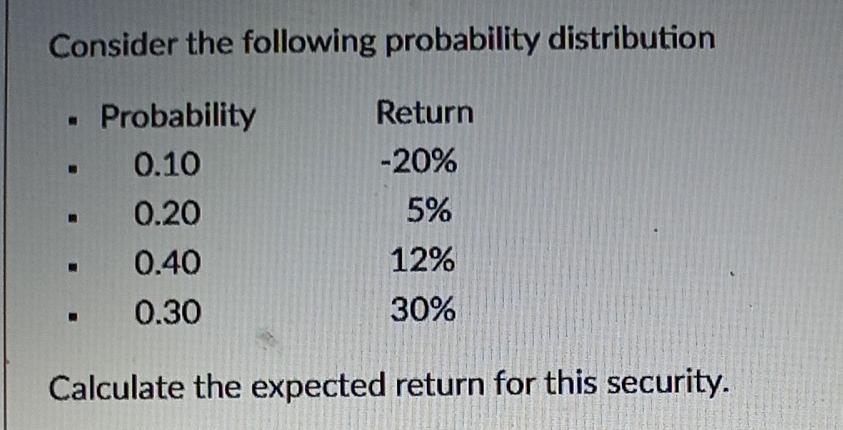

Consider the following probability distribution Probability 0.25 Return -20% 0.50 10% ho 0.25 36% Calculate the standard deviation for this security. Choose the correct statement regarding standard deviation. (This is a multiple answer format question which means you should check all that apply...there may be more than one correct response). If the standard deviation is zero, the actual return will always equal the expected return All else equal, the lower the standard deviation the riskier the investment is as a stand-alone investment All else equal, the higher the standard deviation the riskier the investment is as a stand-alone investment You are considering the purchase of a new stock. The stock is forecasted to pay a dividend next year (D1) of $1.35. In addition, you forecast that the firm will have a stable growth rate of 2.8% for the foreseeable future. The current risk-free rate of return is 3.7%. The expected return on the market is 9.8% and the standard deviation for the market is 16%. The stock has a correlation to the market of 0.32. Finally, the stock has a standard deviation of 25%. Given this information, what is the value of this stock? (Hint: Use the constant growth pricing model) Choose the correct statement regarding expected return o If stock A has an expected return of 7% and stock B has an expected return of 12%, stock B will generate a higher return for investors over the next year than stock A. None of the the other answers is correct An expected return of 10% means that our most likely return for the next year is 10% O An expected return of 10% means that we will earn 10% on our investment over the next year Consider the following probability distribution Probability 0.10 0.20 0.40 0.30 Return -20% 5% 12% 30% Calculate the expected return for this security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts