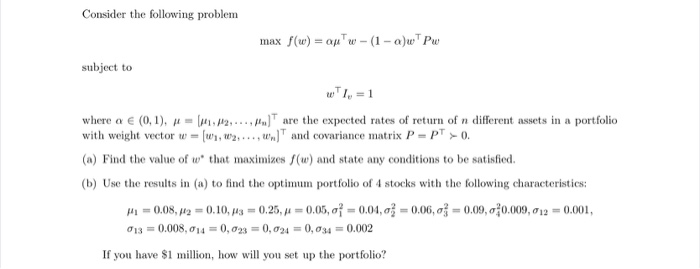

Question: Consider the following problem max /(w) = ap'w - (1 -a)w' Pw subject to w1=1 where a (0,1), H = 1,2,... ) are the expected

Consider the following problem max /(w) = ap'w - (1 -a)w' Pw subject to w"1=1 where a (0,1), H = 1,2,... ) are the expected rates of return of n different assets in a portfolio with weight vector w = (1,62,.....)" and covariance matrix P = P >0. (a) Find the value of w' that maximizes (w) and state any conditions to be satisfied (b) Use the results in (a) to find the optimum portfolio of 4 stocks with the following characteristics: 44 -0.08.12 = 0.10,83 = 0.25, y = 0.05, -0.01,02 -0.06, 03 -0.09,0 0,009,012 -0.001, 013 = 0.008,014 = 0,093 = 0,024 = 0,034 = 0.002 If you have $1 million, how will you set up the portfolio? Consider the following problem max /(w) = ap'w - (1 -a)w' Pw subject to w"1=1 where a (0,1), H = 1,2,... ) are the expected rates of return of n different assets in a portfolio with weight vector w = (1,62,.....)" and covariance matrix P = P >0. (a) Find the value of w' that maximizes (w) and state any conditions to be satisfied (b) Use the results in (a) to find the optimum portfolio of 4 stocks with the following characteristics: 44 -0.08.12 = 0.10,83 = 0.25, y = 0.05, -0.01,02 -0.06, 03 -0.09,0 0,009,012 -0.001, 013 = 0.008,014 = 0,093 = 0,024 = 0,034 = 0.002 If you have $1 million, how will you set up the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts