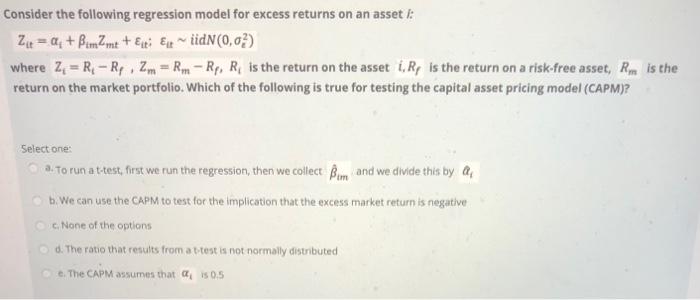

Question: Consider the following regression model for excess returns on an asset : Zu= a + Bum2mt + Eiki Eixid(0,0%) where 24 = Re - R,

Consider the following regression model for excess returns on an asset : Zu= a + Bum2mt + Eiki Eixid(0,0%) where 24 = Re - R, 2m = Rm Rp, R, is the return on the asset i, Ry is the return on a risk-free asset, Rom is the return on the market portfolio. Which of the following is true for testing the capital asset pricing model (CAPM)? Select one: a. To run a t-test, first we run the regression, then we collect Bum and we divide this by a b. We can use the CAPM to test for the implication that the excess market return is negative None of the options d. The ratio that results from a t-test is not normally distributed e. The CAPM assumes that 0.5 Consider the following regression model for excess returns on an asset Zu-a,+Bum & mid(0.0%) where Z-R-Rp.2.-R.-RR is the return on the asset LR is the return on a risk-free asset. R. is the return on the market portfolio. Which of the following is true for testing the capital asset pricing model (CAPM)? Select Torun test we run the regression, then we collect Awe divide this by a the CAPM so test for the implication that the marketing DO dhe harte normally wikited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts