Question: Consider the following scenario (the given information is the same as in the previous question): Suppose a company has 100 million common shares outstanding,

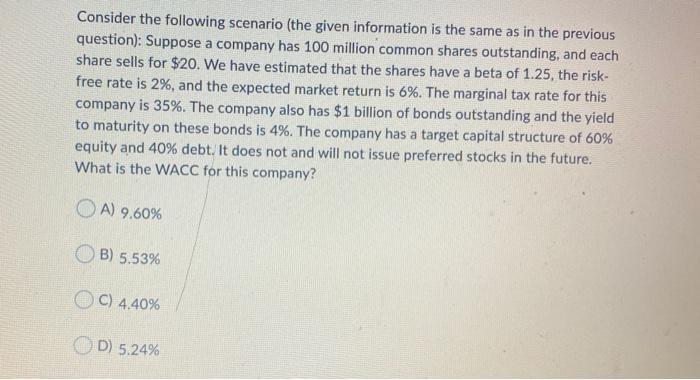

Consider the following scenario (the given information is the same as in the previous question): Suppose a company has 100 million common shares outstanding, and each share sells for $20. We have estimated that the shares have a beta of 1.25, the risk- free rate is 2%, and the expected market return is 6%. The marginal tax rate for this company is 35%. The company also has $1 billion of bonds outstanding and the yield to maturity on these bonds is 4%. The company has a target capital structure of 60% equity and 40% debt. It does not and will not issue preferred stocks in the future. What is the WACC for this company? A) 9.60% B) 5.53% C) 4,40% D) 5.24% Consider the following scenario (the given information is the same as in the previous question): Suppose a company has 100 million common shares outstanding, and each share sells for $20. We have estimated that the shares have a beta of 1.25, the risk- free rate is 2%, and the expected market return is 6%. The marginal tax rate for this company is 35%. The company also has $1 billion of bonds outstanding and the yield to maturity on these bonds is 4%. The company has a target capital structure of 60% equity and 40% debt. It does not and will not issue preferred stocks in the future. What is the WACC for this company? A) 9.60% B) 5.53% C) 4,40% D) 5.24%

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the weighted average cost of capital WACC we need to consider the cost of equity and the cost of debt weighted by their respecti... View full answer

Get step-by-step solutions from verified subject matter experts