Question: Consider the following simpli e d version o f the model w e studied i n class. The world consists o f two countries, called

Consider the following simpli version the model studied class.

The world consists two countries, called home and foreign. All variables interest

rates are and measure deviations from zeroshock equilibrium levels. Foreign variables are

denoted with asterisk.

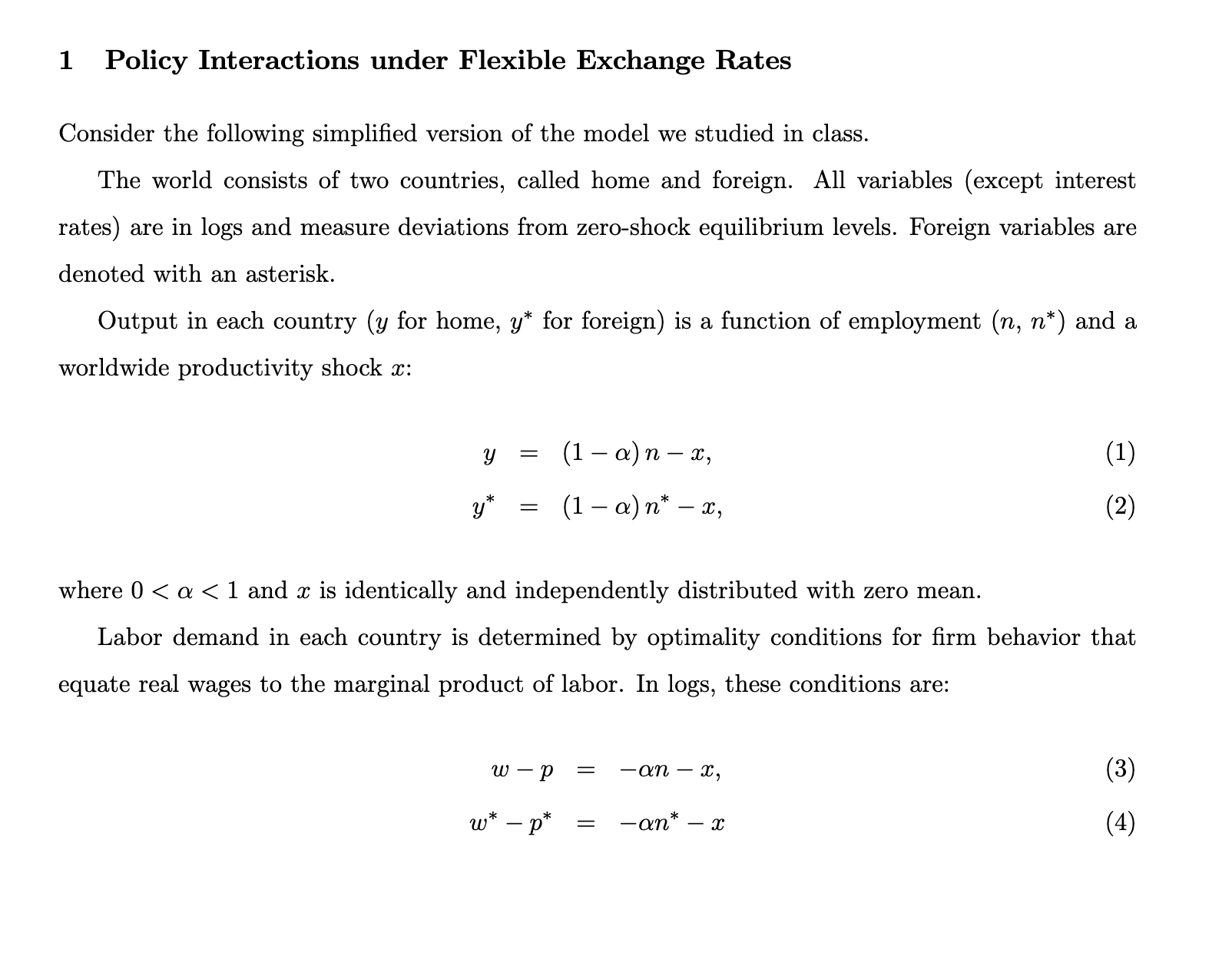

Output each country for home, for foreign a function employment and

worldwide productivity shock :

;

;

where and identically and independently distributed with zero mean.

Labor demand each country determined optimality conditions for behavior that

equate real wages the marginal product labor. these conditions are:

;

and are the nominal wages, and and are product prices.

Consumer price levels are given :

;

;

where the share spending the home good consumers each country

the nominal exchange rate home currency per unit foreign and the terms trade,

the home good per unit the foreign good

Expenditure equilibrium conditions for the home and foreign goods are:

;

;

where and and and are the ante real interest rates.

Denoting nominal interest rates with i and and are determined :

;

;

where

the expected value the home CPI one period ahead based

the currently available information.

Optimal bond holding behavior the two countries implies uncovered interest rate parity :

:

Proceeding the slides, use the ante real interest rate equations and UIP

the CPI equations and and the the terms trade

show that that equations and can rewritten :

;

:

Denoting money demand money supply equilibrium with home and

the foreign country, money market equilibrium each country requires:

;

:

Note: are simplifying the model studied class removing the interest rates

money demand. The money market equilibrium conditions above are thus analogous those

Barry Eichengreen model policy interactions under the interwar Gold Standard.

Proceeding the slides, show that prices and employment each country are such that:

;

;

and

;

:

Assume that and workers each country agree wages set the end the previous

period minimize the expected squared deviation employment from the zero shock equilibrium

each country. other words, chosen minimize

and chosen minimize

where denotes the expectation conditional information available the end

the previous period.

Assume that the exchange rate and central banks use the respective money supplies

their policy instruments. Central banks choose money supplies minimize loss functions that

depend the squared deviations CPI and employment from their zero shock levels.

other words, policymakers have motive move their money supplies other than responding

shocks:

;

;

where Assume that central banks care more about than employment,

Proceeding the slides, show that the assumptions are making imply that wage setting

results

Use a superscript denote the between home and foreign variables instance,

Use the money market equations and the expenditure equations

and equations and the result about wage setting above show that the

exchange rate determined :

:

Why didn have use the UIP equation part exchange rate determination like

the slides? : Think about the money demand equations and compare the exchange

rate solution above the one the slides.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock