Question: Consider the following single index specification: R = a + RM + ei. Where R, is the return on security i (X or Y),

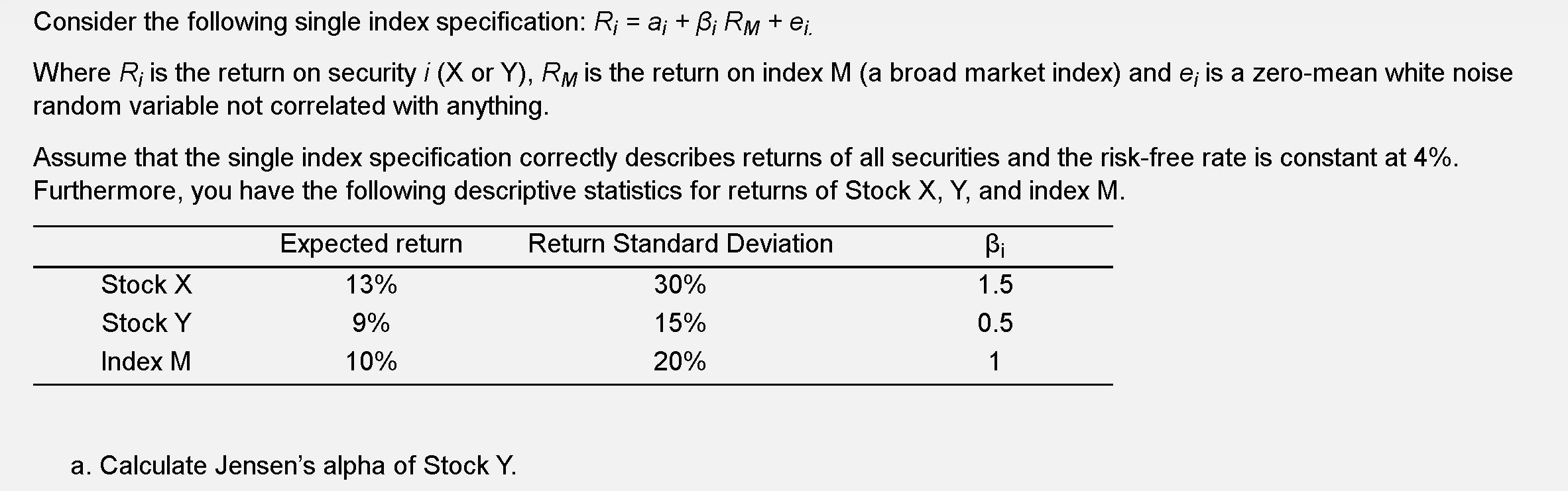

Consider the following single index specification: R = a + RM + ei. Where R, is the return on security i (X or Y), RM is the return on index M (a broad market index) and e; is a zero-mean white noise random variable not correlated with anything. Assume that the single index specification correctly describes returns of all securities and the risk-free rate is constant at 4%. Furthermore, you have the following descriptive statistics for returns of Stock X, Y, and index M. Stock X Stock Y Index M Expected return Return Standard Deviation 30% 15% 20% 13% 9% 10% a. Calculate Jensen's alpha of Stock Y. Bi 1.5 0.5 1

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Jensens alpha is a measure of riskadjusted performance that ... View full answer

Get step-by-step solutions from verified subject matter experts