Question: Sekitar Berhad Sekitar Berhad's capital structure is as follows: Bonds: 15-year, semi-annual coupon bond with a coupon rate of 8%. The bond was issued

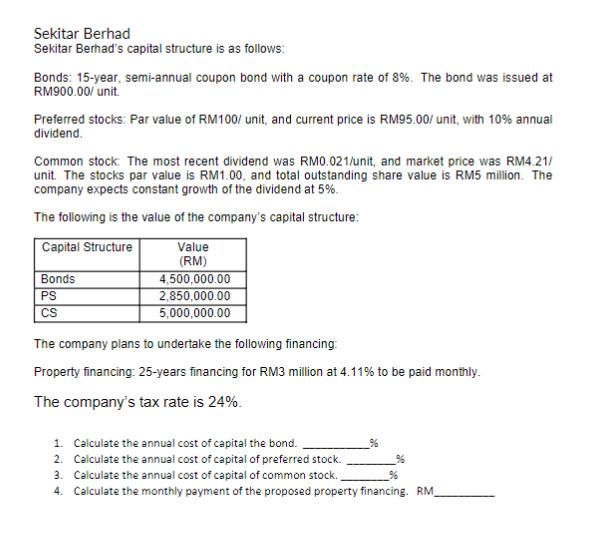

Sekitar Berhad Sekitar Berhad's capital structure is as follows: Bonds: 15-year, semi-annual coupon bond with a coupon rate of 8%. The bond was issued at RM900.00/ unit. Preferred stocks: Par value of RM100/unit, and current price is RM95.00/ unit, with 10% annual dividend. Common stock: The most recent dividend was RM0.021/unit, and market price was RM4.21/ unit. The stocks par value is RM1.00, and total outstanding share value is RM5 million. The company expects constant growth of the dividend at 5%. The following is the value of the company's capital structure: Capital Structure Value (RM) Bonds PS CS 4,500,000.00 2,850,000.00 5,000,000.00 The company plans to undertake the following financing: Property financing: 25-years financing for RM3 million at 4.11% to be paid monthly. The company's tax rate is 24%. 1. Calculate the annual cost of capital the bond. 2. Calculate the annual cost of capital of preferred stock. 3. Calculate the annual cost of capital of common stock. %6 4. Calculate the monthly payment of the proposed property financing. RM % 96

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

1 Annual Cost of Capital of Bond Coupon Rate x Par Value Price 8 x RM900 RM900 ... View full answer

Get step-by-step solutions from verified subject matter experts