Question: Consider the following table comparing the 4-factor alpha of a portfolio of founder-CEO firms to that of a portfolio of non-founder-CEO firms. (Standard errors are

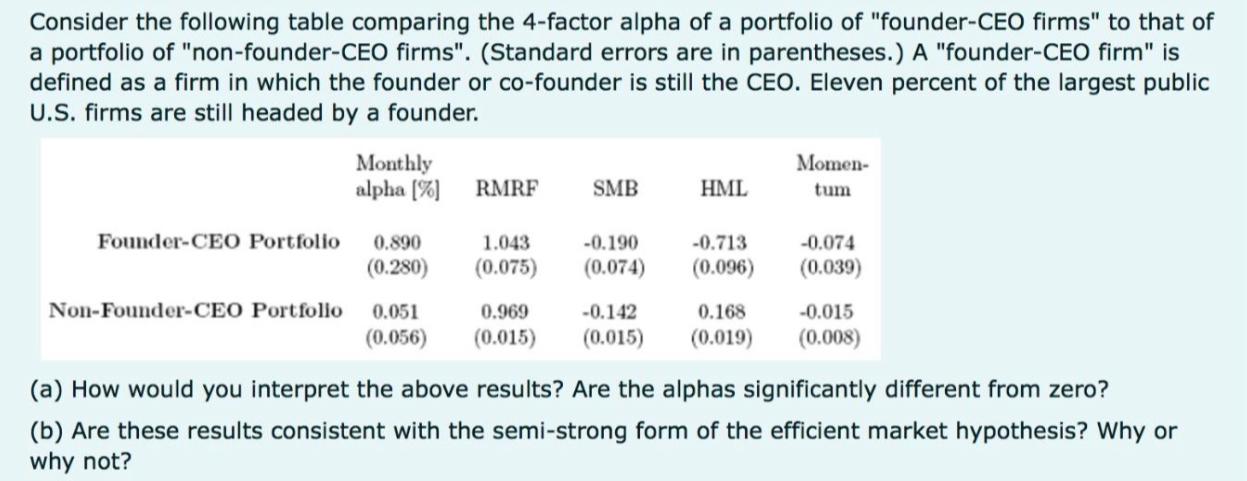

Consider the following table comparing the 4-factor alpha of a portfolio of "founder-CEO firms" to that of a portfolio of "non-founder-CEO firms". (Standard errors are in parentheses.) A "founder-CEO firm" is defined as a firm in which the founder or co-founder is still the CEO. Eleven percent of the largest public U.S. firms are still headed by a founder. (a) How would you interpret the above results? Are the alphas significantly different from zero? (b) Are these results consistent with the semi-strong form of the efficient market hypothesis? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts